July 15, 2020

DJIA 26,870

S&P 500 3,229

10-Year Treasury 0.63%

Dear Clients and friends,

This letter is a mid-year update, which accompanies your semi-annual reports. We hope that you and your loved ones are safe from Covid-19.

Here is a PDF version of this letter. RBS_InvestorLetter_July2020 – Final

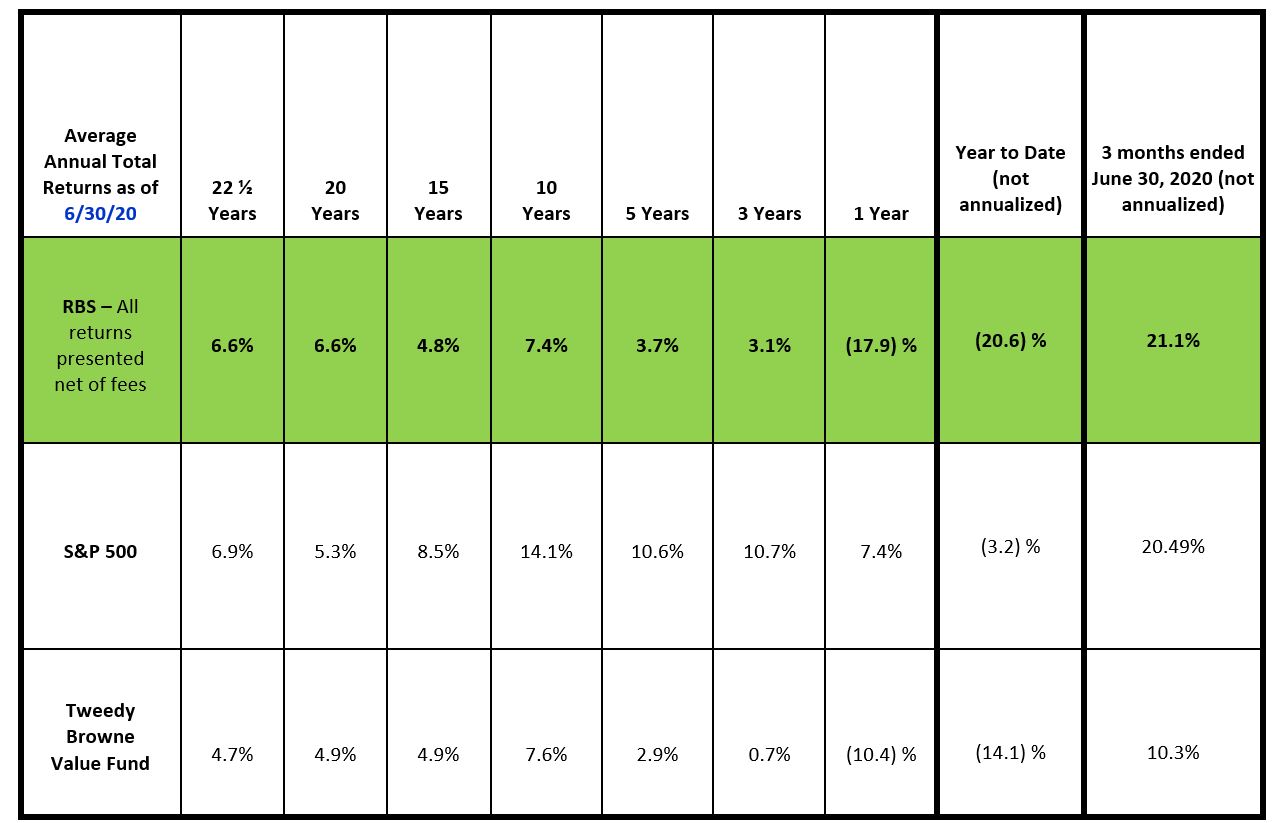

Please notice we have removed the Vanguard Balanced Index Fund (VBINX) as a comparison and substituted it with the Tweedy Browne Value Fund (TWEBX). This presents a more accurate reflection of our value investing style. The S&P 500 remains as a comparative benchmark, as it is a standard recognized worldwide index. We have mentioned in the past that we do not think the S&P 500 is a proper benchmark in evaluating us, only because much of our investing is not in S&P 500 situations.

We slightly exceeded the S&P 500 for the second quarter of 2020 and have under-performed the S&P 500 for the 6-months ended June 30, 2020. We are in unprecedented times with the Corona virus and economies across the globe essentially are still partially shut down.

We have been diligent in our research and we ponder many avenues. We have been focused in positions and sectors that did much worse than the S&P500 during the first quarter of 2020. These industries include energy (oil, refining, distribution, natural gas, renewables and solar) and, financial services. We also are invested in Alaska Air (ALK $36.26), which was down 46% during the first half of 2020.

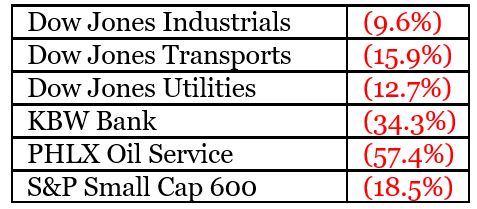

The following is a table of how other comparative indexes did during the 6 months ended June 30, 2020:

RBS Performance Summary:

Please refer to our Disclosures page.

Our investment approach remains consistent to our long-time methods. We practice value investing. We try to find companies or investments that we feel are selling at a price that is below their intrinsic value. We emphasize a long-term approach to investing. We focus on the investment itself and not its short-term stock price performance.

Value investing has underperformed growth investing since the financial crisis of 2007 -2009. We think, but do not promise that value investing will once again become beneficial to investors. We always keep our eyes open for new ideas, and we constantly inspect our methods for potential errors and/or changes.

“Value investing works like clockwork, but sometimes your clock has to be very slow.” Joel Greenblatt Barron’s October 17, 2016

The question arises, “Is value investing dead?” “Yes, no, maybe, and I don’t care. That about covers it.” Joel Greenblatt

We are not at all focused on short term results. It is our opinion that no one can consistently time markets. Our clients should recognize that most of what has been discussed in this letter has always been our central investment theme for the last 25 years. What has clearly changed over the years is our ability to work with information via communications and technology, and the accumulated knowledge of 25 years of in-depth research and constant reading.

Some recent investment thoughts of ours:

1. We are clearly in a recession, and perhaps even a financial depression. Banks and financials were down over 34% for the six-months ended June 30, 2020. It is our opinion that unlike during the financial crisis, banks are in an income statement recession, and not a balance sheet recession. The banks and financials we own today have balance sheets and capital levels that are much stronger than they were leading up to the financial crisis.

2. On April 20, 2020, the price of WTI crude was a negative ($35.04) for a short period. The price was $41.03 on July 15, 2020. The magnitude of this reversal is incredible. Was the price increase merely a reversion to the mean? Is it a sign of future inflation? Was the negative price of oil merely reflecting the world-wide concern of Covid-19? On another note, the price of natural gas hit a 25-year low, of $1.43 on June 26, 2020. The price of natural gas was $1.78 on July 15, 2020. At some point, we expect an uptick in the price of natural gas, which could benefit utilities and energy companies.

3. We are concerned with severe speculation in various sectors of the market. Stocks should be priced at some level of discounting of future cash flows. We are nervous that stock prices of many NASDAQ companies are being fueled by massive investor buying, as opposed to expected future cash flows. Many Americans are making more money via their unemployment checks and the Government stimulus checks, than they were making when they were employed in the workforce.

4. Corporate debt levels are increasing to a level we are certainly concerned with. We are worried that many of these leveraged companies will not be able to service their loans. If companies begin to default on loans or are forced to refinance at terms that are less friendly than they are now, that could become reflected in lower prices of stocks. To avoid business defaults, companies will need to see rising revenues in the not too distant future. Revenue growth in theory could cure all, and that is what Central Bankers are hoping for. We have always used the premise that hope is not a proper investment strategy.

We do expect increasing revenues, but we also expect decreasing profit margins due to higher costs, and even the possibility of higher taxes in the near future.

Some quick mentions about some of our current investments:

Our expected dividend yield at June 30, 2020 was 3.6%:

Historically, we felt most secure when a company’s dividend is 67% of the 5-Year Treasury. Our expected dividend yield as of June 30, 2020 is 3.6%. The current 5-Year U.S. Treasury yield was 0.31% on June 30, 2020. Our current expected dividend is 1,161% > the 5-year Treasury. From a dividend standpoint, we have a margin of safety, that has increased substantially as rates dropped. Our expected dividend yield has widened dramatically to various Treasuries. Yet, these are incredibly unusual times, and we do not know how long the world economies will be partially or totally shut down. We also do not know if our companies will materially reduce their dividends, or if interest rates will once again edge up.

On September 30, 2019, a 5-year CD had an interest rate of 2.76%. As of today, a typical 5-year CD has an interest rate of less than 0.4%.

iShares 0-5 Year TIPS Bond ETF (STIP $102.64):

We have a 5.4% position in TIPS (Treasury Inflation Protected Securities). The current components of this ETF are made up of 100% AAA U. S. Treasury Inflation-Indexed Bonds. These bonds have a 2.60-year maturity (and duration). This investment gives the safety of short-term treasuries, along with a protection from inflation. Inflation has been non-existent for almost 30 years. We are concerned that the magnitude of Covid-19 deficit spending, growth in money supply, closed economies eventually fully reopening, and Covid-19 related government funding, could turn out to be inflationary in the future. We have also seen a resurgence of bringing industry back to the USA, and that very well could occur with higher prices. We have been accumulating shares and expect that will continue over the foreseeable future. We expect this investment will be liquid, fairly conservative, and to be able to generate funds from this, should the opportunity rise to buy specific company investments.

A discussion of several of our Short Positions:

We are using shorts as a hedge to our current long positions in our taxable accounts. Tax deferred accounts do not allow for shorting. One must have a taxable margin account to have short positions.

Brookfield Asset Management (BAM $34.86):

We have a short position of Brookfield Asset Management, with a cost basis of ~$29.38 and a ~5% portfolio allocation. Our investment thesis is based on a potential price contraction of Commercial Real Estate and alternative assets of private equity. The company also has a great deal of debt, and a reliance on the continued access to low cost credit from the debt markets.

Various Credit Related ETF Short Positions:

We have a large short position, with a ~20% portfolio allocation, in several ETF’s that invest in either high yield bonds or investment grade bonds. Our short thesis is based on our perception of excess leverage and improper bond pricing of High Yield (aka junk bonds) ETFs. The U.S. Government instituted a program to buy investment grade bonds at the beginning of the Covid-19 crisis. Our thesis also includes potential downgrades of BBB credits (lower medium grade), to non-investment grade. If downgrades occurred, we would expect pricing pressure on these bonds. U.S. corporate downgrades reached a record high during the second quarter. The two-investment grade ETF’s we are short, have about 50% of their assets in lower medium grade bonds. These include iShares Investment Grade Corporate Bond ETF (LQD $136.57), and Vanguard Intermediate Term Corporate Bond ETF (VCIT $95.70).

We have a short positions in two ETF’s that are mostly composed of non-investment grade (junk) bonds. We did cover half our shorts in these two funds during the lows (so far) during March. These shares are no longer available to short, and that is why we substituted our shorts for higher grade offerings. These include SPDR Bloomberg Barclays High Yield Bond ETF (JNK $103.23), and iShares High Yield Corporate Bond ETF (HYG $83.21).

Our year to date gains on these 4 short positions was 5.5% through June 30, 2020.

In summary our short position in lower quality corporate bonds is based on our concern of excess leverage and a suspicion that liquidity of these bonds will slow down or dry up, and that downside pressure will be priced into these bonds. Many of these bonds are covenant lite, which means the borrower basically puts up less collateral and has less restrictions on their finances. This could be a concern going forward if the company who issues the debt is no longer capable of servicing their debt.

As always, please let me know if you would like to have a discussion to discuss finances or investments.

If you have any concerns, please reach out to me.

You can also follow us on twitter http://www.twitter.com/rbco as well as on Facebook http://www.facebook.com/RedfieldBlonsky.

We hope you are and remain healthy and safe.

Respectfully submitted,

REDFIELD, BLONSKY & STARINSKY, LLC

Ronald R. Redfield, CPA, PFS

Partner

Important Disclosures

1. Redfield, Blonsky & Starinsky, LLC (RBS), only transacts business in states where it is properly registered or excluded or exempted from registration requirements.

2. Past performance assumes reinvestment of dividends and other distributions and may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended and/or purchased by adviser), or product made reference to directly or indirectly in this presentation or on our website, or indirectly via a link to any third-party website, will be profitable or equal to corresponding indicated performance levels. The investment return and principal value of an investment will fluctuate and, when redeemed, may be worth more or less than their original cost.

3. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. No client or prospective client should assume that information presented is a substitute for personalized individual advice from the adviser or any other investment professional.

4. Historical performance results for investment indexes, such as the S&P 500, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results of the S&P 500 Index. Whenever RBS performance is referred to, results have been reduced by all fees, including RBS management fee.

5. Returns for the RBS portfolios have been calculated using actual time-weighted returns obtained from all accounts over the time periods indicated. All RBS returns assume the reinvestment of dividends and are shown net of the investment management fees and all other expenses. Please see our form ADV for a full fee disclosure. Actual individual account performance may be materially different from our composite results.

6. RBS files an annual form ADV, which includes an easy to read brochure. Form ADV is a valuable read for anyone interested in learning more about RBS. Additional information about Redfield, Blonsky &Starinsky, LLC is also available on the SEC’s website at www.adviserinfo.sec.gov . The searchable IARD/CRD number for Redfield, Blonsky & Starinsky, LLC is 128714.

7. The S&P 500 Index is a widely recognized, unmanaged index of 500 of the largest companies in the United States as measured by market capitalization. The S&P 500 Index performance assumes reinvestment of all dividends and distributions and does not reflect any charges for investment management fees or transaction expenses, nor does the Index reflect any effects of taxes, fees or other types of charges and expenses. The S&P 500 Index is one of many indices and is not necessarily the most appropriate index when comparing performance results.