September 16, 2005 Some notes I took this week, as I prepared for a discussion I am participating in on 9/17/05. Quite a bit of ramblings. One can see some of the work that goes into our analysis by reading below. Feel free to call or email with thoughts or questions.

The following is a collection of data from my research which started on September 12, 2005. This collection is being presented in a quick informal discussion on September 17, 2005.

Consumer Sentiment fell in August according to University of Michigan Survey. Consumer sentiment is a survey of consumer confidence conducted by the University of Michigan. The preliminary report is released on the tenth (except on weekends) of each month. A final report for the prior month is released on the first of the month.

According to the Conference board, the sentiment increased in August. According to pg 29 of 9/12/05 BusinessWeek magazine, the sentiment is expected to decrease in September.

http://www.conference-board.org/economics/consumerConfidence.cfm

I am not familiar as to why there would be differences. Both of these surveys were taken prior to Katrina.

2.Value Line on September 9, 2005 mentioned the following: (see comparison below for 9/16/05 Value Line).

a. Surging gasoline prices and rising employment levels are proving to be offsetting trends for the consumers.

b. Capital goods demand is still healthy.

c. Construction spending holding up.

d. Record oil prices will take its toll on growth. VL expects 3.5% or less after this year.

3.Value Line economic commentary 9/16/05

a. expects economy to stay strong, yet growth which they previously felt might top 4% is expected to slow to 3.0% to 3.5% in 4Q05.

b. Modest slowing growth in 2006. Thinks 3.0% growth is sustainable in 2006. Expects growth from 2007 – 2010 to be in the 3% – 4% range.

4.Some interest rate comparisons

| 9/8/05 | 9/1/05 | 6/2/05 | 9/2/04 | |

|---|---|---|---|---|

| Discount Rate | 4.50 | 4.50 | 4.00 | 2.50 |

| Prime Rate | 6.50 | 6.50 | 6.00 | 4.50 |

| Bank CDs 1 year | 2.97 | 2.91 | 2.80 | 1.47 |

| 10 Year Treasury | 4.15 | 4.03 | 3.90 | 4.21 |

| 30 Year Treasury | 4.43 | 4.30 | 4.25 | 5.16 |

| 10 Year Canadian Bonds | 3.85 | 3.74 | 3.82 | 4.64 |

| 10 Year German Bonds | 3.07 | 3.07 | 3.22 | 4.07 |

| 10 Year Japan Bonds | 1.34 | 1.34 | 1.22 | 1.50 |

5. Retail Sales for Aug. registered the largest decline in nearly four years for the total rate, which fell 2.1% (consensus -1.4%).

6. The following are some quick thoughts, I try to formulate these on a whiteboard in my office. They are confused and confusing. Arggggh!!! Just looking for answers as i search endlessly. Hopefully these thoughts will evolve into prudent decision making.

a. Producer costs are rising. This was happening prior to oil shock and Katrina. Will this cause inflation? Will this cause deflation via reduced demand for goods? Maybe housing deflation and consumer slowdown. Incidentally, I recently initiated a short position in Toll Brothers (TOL 47.69) as a portfolio hedge and to invest in my belief that we are in a housing bubble. I look at the housing market and the growth and am reminded of the tech bubble of the late 90’s. I just can’t fathom Toll Brothers revenues growing at 15% to 20% pace for many years, as at some point the consumer will be fully invested in real estate. The comps just look like they will be tough. With that said, I certainly am not a housing expert.

b. Producer prices have increased, whereas consumer prices have not yet risen in the same fashion. I think consumer prices are a lagging indicator. I think that CPI has lagged PPI for some time now. There was an article on PPI in IBD this week, which mentioned that firms are not raising prices to consumer. Efficiency is enabling these firms to currently continue profitably. Of course, this could change after the recent oil shock, Katrina and aftermath kicks in.

Will consumer be affected? I think so, big time. I think retail and consumer materialism will have text book and generational changes. I think the days of the drunken consumer are ending. I think that there will be a revolutionary refocus on savings, and at the same time a negative image of consumerism.

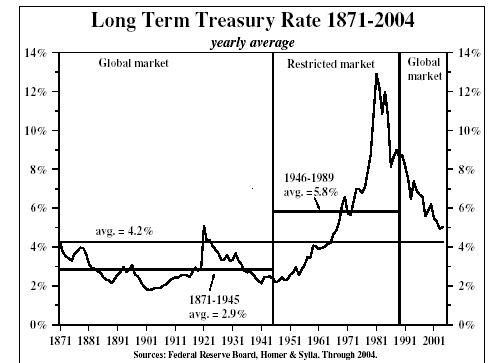

What will interest rates do? I am clueless on this one. We continue to keep our Fixed Income durations and maturities as low as possible. The contrarian in me has me thinking that perhaps long terms will not rise to difficult levels. Yet, part of me wonders how the 10 year can stay flat year over year, whereas short rates have risen dramatically. please see chart in part 4 above. Notice how longer term rates have dropped year over year, whereas short term rates have increased by 80%.

How about US Dollar? Gold? We have virtually no position left in Gold . We have had a position in Precious Metals for my entire career and now have abandoned it, probably a big mistake. Please keep in mind that some portfolios still contain a small precious metals position.

If oil does come down, we could have beneficial comps from the cost side in a year or a couple.

If my thesis above is correct. I am trying to find beneficiaries and sufferers. Yet, if things do get bad economically, and if a bear re-emerges, i guess the winner will be the one who loses least. I was thinking that perhaps Alcoa could be a beneficiary. Perhaps inflation would bring Aluminum up in price and benefit Alcoa? Perhaps a US recession would not necessarily curtail world infrastructure growth, also a potential Alcoa beneficiary.

Perhaps technology would benefit and it is less energy dependent, perhaps more telecommuting. Not raw material and shipping dependent. Perhaps broadband companies and data networking suppliers and providers.

Some of the sufferers could be luxury homebuilders, subprime lenders, aggressive lenders and companies that produce . discretionary purchases.

7. Katrina effects:

a. 9% of US refineries output were not operating as of 9/10/05 (BW)

b. consumer spending could fall. This could be because of oil prices if they remain over $3 per barrel. Keep in mind that prices were rising pre-Katrina.

c. Air Carriers will be hit with rising fuel costs.

d. All US ports are running near capacity, hence closure of New Orleans port could have transport effects. This could be short lived. Moving the fall harvest is in question. Just brainstorming here, but you could see food companies profits hurt in the short term, and then potentially rising prices on necessities after that. Perhaps this will enable the CPI to catch up to PPI.

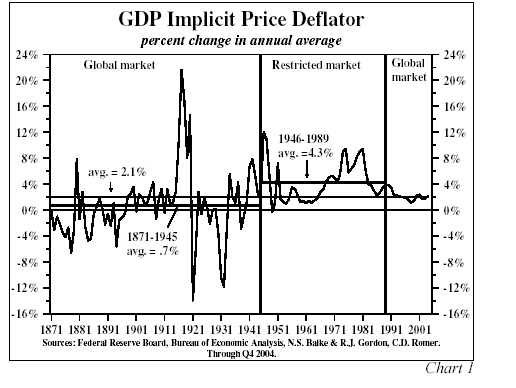

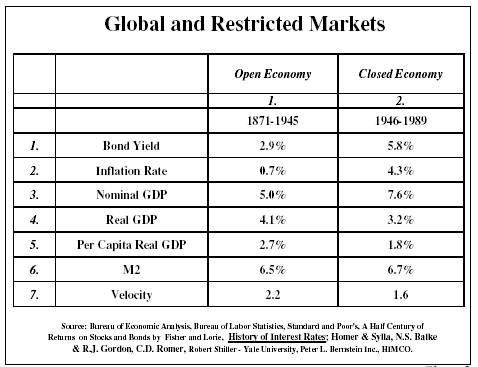

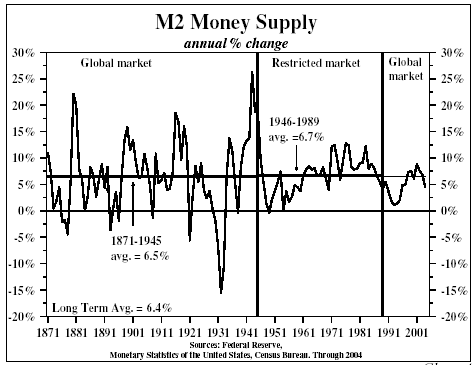

Some Interesting graphs:

9. Headlines I saw this week:

a. “More Homeowners get comfy with second, third properties.” (IBD)

b. “Impact of Katrina hits Domino as sugar refinery is shuttered.” (WSJ)

c. “Kraft introduces 2 somewhat healthier cookies made of whole grains.” (NYT) ( trend towards whole wheat flour instead of refined and bleached white flour) (whole wheat contains fiber)

d. “Post- Storm Reports Show U.S. Slowing, Price pressures up” (IBD)

e. “Fed set to go ahead with interest rate increases.” (FT)

f. “Disney warns of $250M losses this quarter.” (FT)

g. “Spain vulnerable to sudden drop in house prices warns S&P.” (FT)

h. “Knight Ridder feels effects of Katrina and newspaper print costs.” (FT)

i. “Employer Health-Care costs rise 9.2%.” (WSJ)

j. “Nokia lifts its earnings forecasts.” (FT)