January 22, 2002

Q1’02

Conference Call Notes and Observations

Lucent Technologies Inc.

3 Months ended December 31, 2001

http://www.lucent.com/press/0102/020122.coa.html

Notes From Conference Call

1. Customers have confirmed with Lucent, that they need and want help from Lucent. The customers have indicated they need to have a path defined to next generation networks (NGN) . Lucent indicated that they most certainly can fit this requirement. Lucent is focused on results not words. Customers have confirmed that spending is down.

2. Improvement in bottom line, even though revenues were way down.

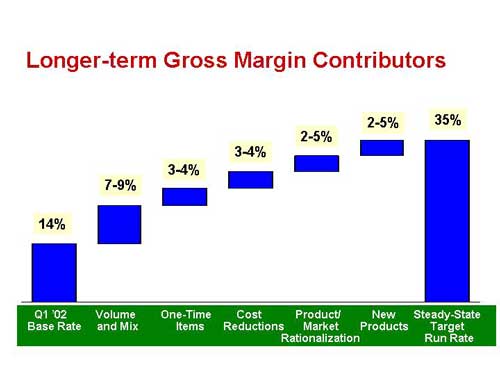

3. Optical revenues were down the most out of segmented revenues (side note, keep in mind that this is an industry wide condition, see JDSU and CIENA for examples) . Service Providers have reduced spending. Mobility solutions decreased 25 % sequentially, but an increase of 24 % from last years comparable quarter. Completed major wireless technologies in Dominican Republic and China (China Telecom). France Telecom will sign a 3 year agreement for always on Internet connections, DSL. Expects gross margins to improve over time. Product lines and sales mix will help achieve these gross margin improvements.

Believes that margins in the 20’s are attainable. This is desired to spin-off Agere.

4. Lambda Unite will be introduced first. Then Lambda Extreme. Other key products will be introduced this year.

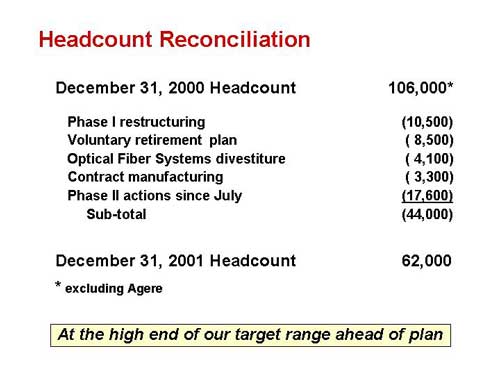

5. Phase II restructuring is going well. Goal is to reduce expenses by 2 billion. A/R efficiency has declined as revenue base has gotten smaller.

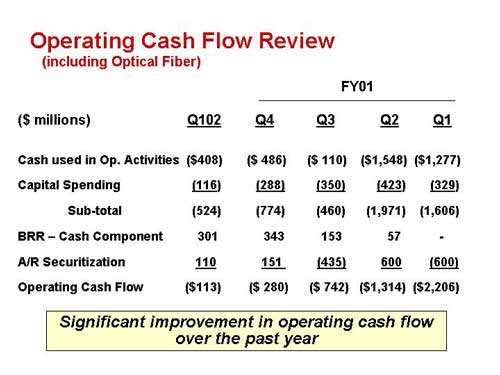

6. Capex was $116 million . They are on track for desired F2002 capex of $ 750 million. Headcount discussion indicated that level will be below 55,000 by June.

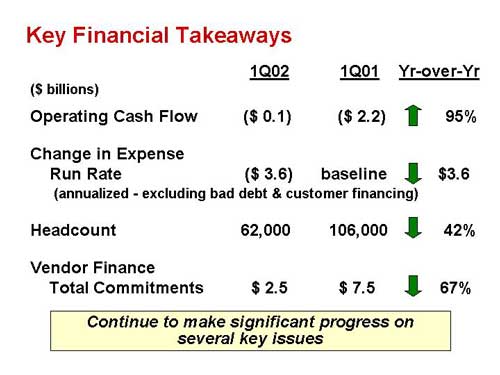

7. Cash Flow discussion. The following chart shows strong sequential improvement. According to Lucent. breakeven cash flow is within sight.

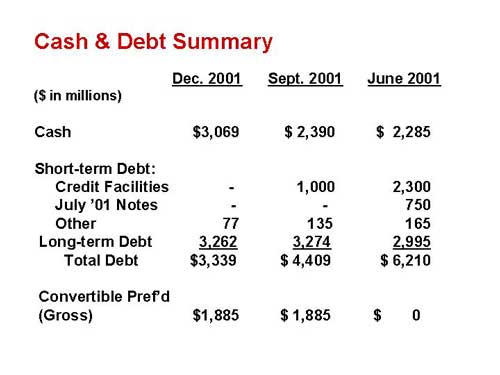

8. Cash balance was $3.1 billion, with no draw down on line of credit. Line of Credit availability is $1.9 billion.

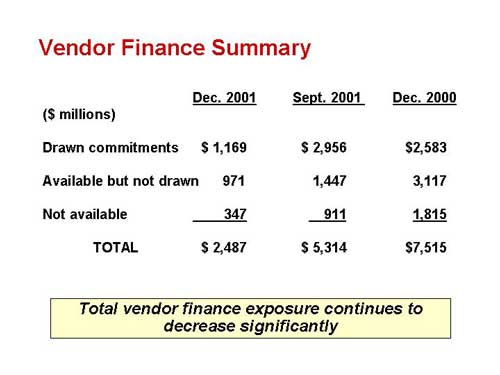

9. Undrawn Commitments slide follows. Lucent sees vendor financing as a “scarce resource”.

10. 95 % improvement in cash flow. Headcount has decreased 42 %. Vendor financing decreased by a 67 % reduction.

11. Breakeven levels will drop before end of fiscal year. Lucent believes that this quarter was the worst we will see in revenue. Believes revenue next quarter will increase 10 – 15 %, with even a greater improvement in bottom line. Lucent believes that breakeven can be attainable at $ 4.25 billion, this is a reduction from prior $ 4.75 billion.

Question and Answer Session

1. Lucent expects good performance in China. Really didn’t describe anything in detail.

2. Paul Sagawa, from Sanford Bernstein asked what happens to Agere and tax free spin-off if EBITDA targets fall short. Lucent described that they intend to spin-off Agere by June 30, 2002. Lucent will request extension from IRS, and expects IRS to grant any needed extension.

3. $ 1.7 billion is still going to be used for Phase II restructuring. This is on target as previously guided. Lucent already projected $2.0 billion, they used $300 million this quarter.

4. For Fiscal year Lucent claims that margins in the 20’s are available to them in Q2’02. Given the uncertainty in the market conditions, they can’t give certainty to these levels. Henry said that they need > 22 % gross margins to achieve positive cash flow. Henry feels that is quite attainable. Reminded us that F2003 gross margin targets are 35 % sometime in 2003. Lucent said they ended December quarter with 62,000 people. Lucent sees this headcount declining by end of June to less than 55,000. These expense reductions will be evident in cash flow shortly.

5. Russo claims that customers are finally realizing the difference between carrier grade products versus “hot new products” . There is a broad based effort by Lucent to identify and satisfy these customer needs.

6. Optical Products. Lambda Unite has been shipped to 2 customers for deployments. 15 trials going on right now. LambdaExtreme no deployments, but 15 trials. In the Metro, there are 20 trials going on and we will see announcements shortly. LambdaRouter should have announcements within a month, with a large contract to be announced. Great deal of activity on leading edge optics products.

7. 10 – 15 % expected revenue growth is throughout the business, not isolated with specific segment.

Henry Schacht finished the call by saying that the achievements by Lucent that were discussed one year ago are being met. Organizational changes have been put into place, funding and liquidity has been attacked, CEO has been hired. Henry sounded pleased and Lucent sounds driven to achieve results. Henry is looking forward to a discussion again in 3 months. He looks to accelerate from here. Pat Russo will chair next meeting and Henry said “ I know it will be a marvelous quarter .”

Some “ back of the envelope “ financial observations

1. Revenues of $ 3,579 M are down from $ 5,155 M. This is a decrease of $ 1,576 M and (31 %).

2. The following quoted texts are from my previous conference call notes. It is important to note that we are seeing consistency in what Lucent says and what they continue to guide and achieve.

“Expects headcount target of 57,000 to 62,000 employees to be reached by March 31, 2002. Expects industry revenue decline will be 15-to-20 %, and Lucent’s target market to decline by 10 % or more. Expects bottom line improvement for Q1’02 and sequential revenue decline. Seeing early signs of increased spending in certain areas. Revenues believed to show improvement in Q2’02.” “Expects to reach 35 % gross margins if F2003”. “Capital expenditures targeted at $ 750 M for F2002”.

3. Days Sales Outstanding (DSA) increased to 98 days. This is something I need to monitor as time goes on. We really want to see improvement here. My concerns are that this is not Lucent specific, but possibly a reflection of a very difficult market environment.

4. Debt to Equity ratio is 31.42 % ( (77+3262)/10627). This is down substantially from 40 % in Q4’01. According to my notes prior Debt to Equity was 25 % in F2000, 42 % in F1999 and 35 % in F1998.

5. Current Ratio (Current Assets / Current Liabilities) is 1.86. This is an improvement from 1.58 at Q4’01. This is not an unhealthy ratio.

6. Accounts Receivable decreased $ 1,390 million from Q4’01, yet sales decreased $ 1,576 M. If you project revenues to $16 B for F2002 (not our projection, just a “what-if “ argument) then A/R as a % of revenue would be 20 %. Accounts Receivable, as a % of Revenues was 21.57 % in F2001, 28 % in F2000, 29 % in F1999 and 23 % in F1998.. I previously commented that the 28 % in F2000 was “very acceptable”. Hence F2001 is improved on that, and F2002 is showing the possible early signs of continued improvement.

7. Inventory decreased $ 915 M. Again, if we extrapolate F2002 revenues to an arbitrary $16 billion, the Inventory/ Sales ratio would be 17 %. Inventory / Sales Ratio at F2001 was 17.12 %. This compares to 17.65 % in F2000. Not much of a change, yet Inventory turns is a much better comparison.

8. Acid Test Ratio (CA- Inventory)/CL is 1.51 this is a healthy increase F2001 where it was at 1.22 and from F2000 of 1.01 and F1999 of 1.14.

9. Flow Ratio is desired to be less than 1.25. Current Assets = $ 14,371, Cash = $ 3,069, Current Liabilities = $ 7,732 and Short Term Debt = $ 77.

Flow Ratio = (14371-3,069) / (7732 – 77) = 1.48. The ratio was 1.52 in F2001, 2.85 in F2000 and 2.36 in F1999.

You can read about the Flow Ratio at this link

http://www.fool.com/portfolios/RuleMaker/rulemakerstep6.htm#10

Disclaimer

If you are a client of ours, and if you have questions regarding Lucent, please call our office. If you are not a client of Redfield, Blonsky & Co. LLC Investment Management Division and are reading this report, we urge you to do your own research. We will not be responsible for any person making an investment decision based on this report. This report is a “by-product” of our research. We are not responsible for the accuracy of this report. We are not responsible for errors that may occur in this report. Please do not rely on us to monitor or update this or any other report we may issue. In theory, we could come across some type of data or idea, which causes us to eliminate Lucent from our portfolios. This report is dated January 22, 2002 ; it is possible that by January 23, 2002 we could have eliminated our entire Lucent position without giving notice to any reader of this report. We manage portfolios for clients, and those clients are our greatest concern as it relates to investing. Certain clients of Redfield, Blonsky & Co LLC may not have Lucent Technologies in their portfolios. There could be various reasons for this. Again, if you would like to discuss Lucent Technologies, please contact Ronald R. Redfield, CPA, PFS (partner in charge of investment management division).

Information herein is believed to be reliable, but its accuracy and completeness cannot be guaranteed. Opinions, estimates, and projections constitute our judgment and are subject to change without notice. This publication is provided to you for information purposes only and is not intended as an offer or solicitation. Redfield, Blonsky & Co. LLC and Ronald R Redfield, CPA, PFS, may hold a position or act as an advisor on any investments mentioned in a report or discussion.