December 3, 2015

DJIA 17,636

S&P 500 2071

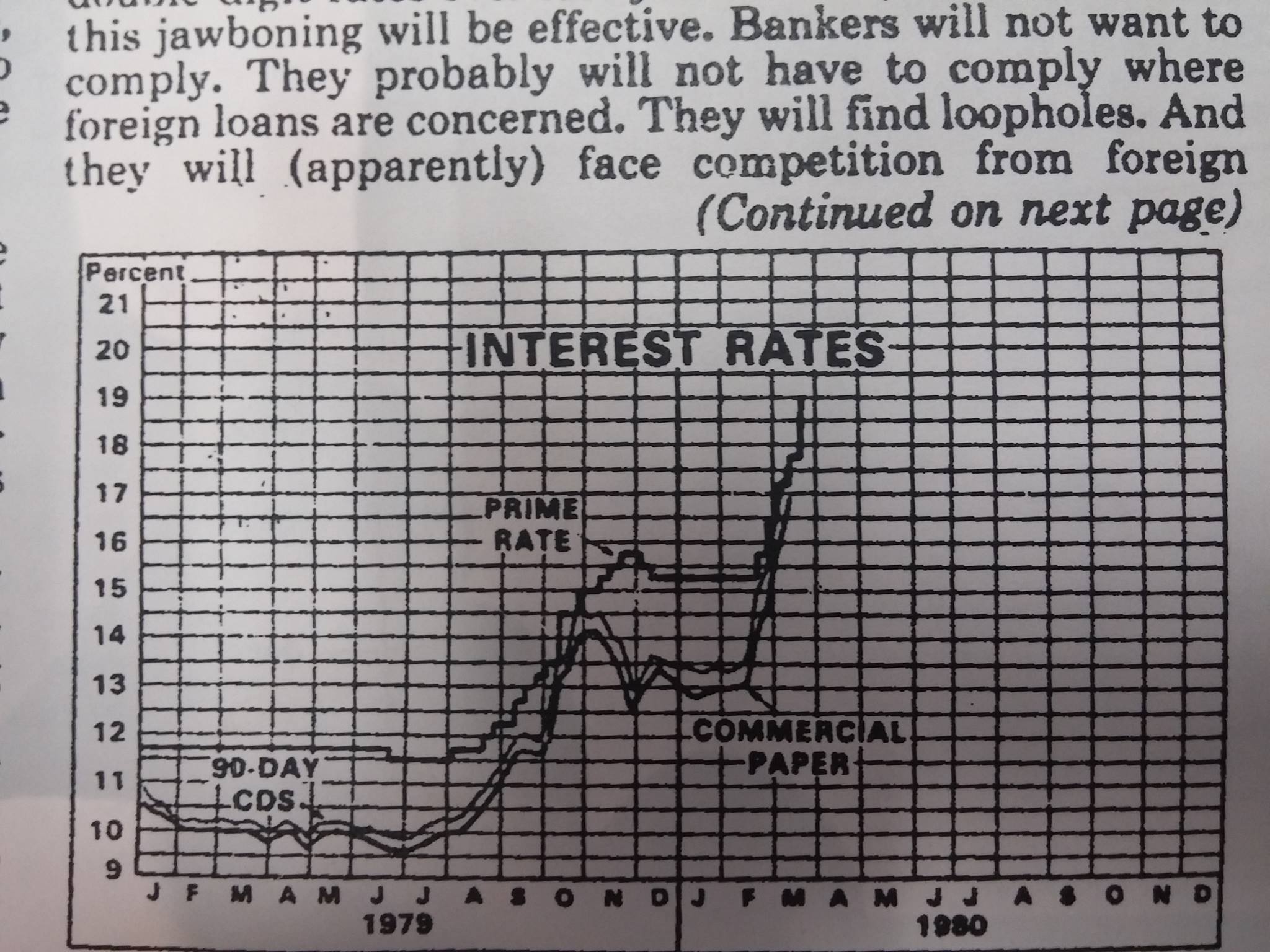

The following are a few quotes and a picture from the March 28, 1980 issue of Value Line. They didn’t know it at the time, but rates were near peaking. Looks like the prime rate was 19%. Imagine now the prime rate going from 3.25% to 19%? As those who read our notes know, we are concerned with the current bond environment. 30 year treasury is yielding 2.29%.

“The recent crash in the bond market- which some observers compare to a 50% drop in the DJIA in a couple of weeks.” Value Line 3/28/80

“The most attractive feature of bank stocks is that most are trading at their lowest P/E multiples ever.” Value Line 3/28/80 page 2002

If you have any concerns, please reach out to me. I would be happy to speak with those who are not clients or ours as well. As always, we welcome the opportunity to discuss our outlook and investments with you.

My email is [email protected]

Please feel free to contact me with anything you would like to discuss. Feel free to ask general questions on our Facebook page as well.

You can also follow me on twitter http://www.twitter.com/rbco as well asyou can follow us on Facebook http://www.facebook.com/RedfieldBlonsky

Respectfully submitted,

Ron Redfield

Ronald R. Redfield cpa, pfs

Redfield, Blonsky & Starinsky, LLC

1024 South Avenue W.

PO Box 2069

Westfield, NJ 07091-2069

https://www.facebook.com/RedfieldBlonsky

908 276 7226 phone

908 264 7972 fax

Disclaimer

If you are a client of ours, and if you have questions regarding the company or investment mentioned in this report please call our office. If you are not a client of Redfield, Blonsky & Starinsky, LLC Investment Management Division and are reading these notes, we urge you to do your own research. We will not be responsible for any person making an investment decision based on these notes. These notes are a “by-product” of our research. We are not responsible for the accuracy of these notes. We are not responsible for errors that may occur in these notes. Please do not rely on us to monitor or update this or any other report we may issue. In theory, we could come across some type of data or idea, which causes us to eliminate our long or short position of the company or investment mentioned in this report from our portfolios. We will not notify reader’s revisions to these notes. We are not responsible to keep readers of these notes updated for changes or material errors or for any reason whatsoever. We manage portfolios for clients, and those clients are our greatest concern as it relates to investing. Certain clients of Redfield, Blonsky & Starinsky, LLC may not have the company or investment mentioned in this report in their portfolios. There could be various reasons for this. Again, if you would like to discuss the company or investment mentioned in this report , please contact Ronald R. Redfield, CPA, PFS (partner in charge of investment management division).

Information herein is believed to be reliable, but its accuracy and completeness cannot be guaranteed. Opinions, estimates, and projections constitute our judgment and are subject to change without notice. This publication is provided to you for information purposes only and is not intended as an offer or solicitation. Redfield, Blonsky & Starinsky, LLC and Ronald R Redfield, CPA, PFS, may hold a position or act as an advisor on any investments mentioned in a report or discussion.