Origen Financial

ORGN

Please see disclaimer at bottom of this document

A REIT that originates and services manufactured home loans.

Manufactured Homes : These are homes built entirely in the factory, transported to the site, and installed under a federal building code administered by the U.S. Department of Housing and Urban Development (HUD). The Federal Manufactured Home Construction and Safety Standards (commonly known as the HUD Code) went into effect June 15, 1976. The federal standards regulate manufactured housing design and construction, strength and durability,

transportability, fire resistance, energy efficiency and quality. The HUD Code also sets performance standards for the heating, plumbing, air conditioning, thermal and electrical systems. It is the only federally-regulated national building code. On-site additions, such as garages, decks and porches, often add to the attractiveness of manufactured homes and must be built to local, state or regional building codes.

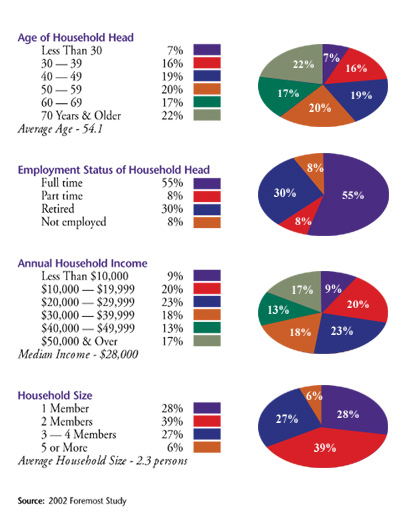

Who Lives in Manufactured Housing?

January 30, 2008 (3.25) A Friendly Discussion with an Anonymous Industry Insider

1. Spoke with an industry expert, who asked to remain anonymous. Is concerned that ORGN as a stock, is in a “death spiral.” Interesting that term was used, as I had used that term several days before in relation to ORGN, but not in relation to this person or any other.

2. This person claimed that Freddie did the October securitization with ORGN based on 10% OC, and also disallowed $30M in the deal. That $30M is sitting in warehouse line. “Freddie tossed out $30 million and then did 90% of what was left.”

3. This person had good things to say about ORGN and Ron Klein. Says morale is certainly a concern at ORGN and some are concerned with employment and looking elsewhere. Says that ORGN servicing is top-notch and that ORGN is just at mercy of credit markets. This person feels Credit Markets could be closed for a long time. Concerned that since warehouse is with Citigroup, who is itself distressed, is concerning.

4. End of the day, this person, when asked if ORGN would survive, said, “I think they will, but I certainly have concerns.”

September 21, 2007 (5.77)

1. A few 13-G’s filed today. Halpern and Woodward still have same shares as 12/31/06.

2. Davidson filed for his ownership of 3,051,667 or11.6% of shares outstanding. This includes an apparent proxy of Woodward and Halpern shares. This filing includes the 1,301,667 shares that are available at a price of 6.24, after bridge financing announced last week.

September 19, 2007 (5.88)

1. I did a quick read of 8K (87 pages), which explained the terms of financing from Davidson. All seemed cool. Davidson is involved with Halpern and Woodward. I am speculating here, but I don’t think he would have committed risk capital, if he didn’t see potential opportunity. I didn’t see anything toxic in there.

2. Some Thoughts:

a. As I mentioned below, securitizations and commercial paper has had terribly difficult times. I do not see, and could be wrong, that ORGN did anything here that was not fiduciary or business improper.

b. The entire industry is in a mess. ORGN will hopefully weather the storm. There paper is not sub-prime and they do not use Gain on Sale accounting.

c. 8% financing is not onerous in my eyes.

d. Davidson has ability to convert shares at $6.24. This price is greater than current price of 5.80ish. This seems like a fair deal for ORGN. Countrywide and Thornburg have done recent deals below book value. Thornburg had to sell valuable assets at a below market price because of desperation. ORGN has not done that.

August 21, 2007 (6.00)

Capital markets not giving much comfort to ORGN. Nothing fundamentally has changed since liquidity crunch. Things are getting marked down. ORGN has had some margin calls because of this.

Citi Hinted that liquidity will continue to be dry and is advising to find equity.

ORGN claims all covenants are intact. They claim that Citi covenants are the least strenuous of all the covenants, but that they are not available as public information. ORGN mentioned that the covenants are very light, and nowhere near violation.

I questioned ORGN as to the following: “Under worst case scenario, what do you think would happen to ORGN’s book value. Do you see the possibility of bankruptcy, if funding remained difficult and even got worse? Would you be able to stop the expense outflow, stop funding and still preserve book value. Hence my question of potential impairment, or worse, any possibility of bankruptcy.” Their response was something as such.

a. Bankruptcy not even near possible.

b. Stock price does not affect covenants.

c. ORGN needs to maintain shareholders equity of about $30M, currently it is around $215M.

d. Worst case scenario, they could see tangible book value taking a 10% hit. Current tangible book is $6.99 per share (25.9M shares), hence 90% of that would be $6.29.

e. According to ORGN all remains fine. Business is fine and liquidity markets have frozen up, and even AAA’s are being marked down to 90% of dollar.

Biggest concern is just a temporary fix and hope that markets get back to normal. They stressed that business has not been better, and that collections were also better than expected.

June 28, 2007 (6.56)

I have no idea on price action. The volume during this 5 day drop has been very low.

HUD code and modular shipments are down through April 30. No biggie as far as I am concerned.

Potential of annual MH shipments < 105K. YTD shipments for top 10 states through 4/07 are 16,420, compared to 25,529 last year. NC is only state up in April

http://www.census.gov/const/mhs/shipment.pdf

Weakness of multi sections in Florida, CA and AZ.

February 27, 2007 Manufactured Housing Monthly 2/26/07 BB&T Notes

1. Full year shipments of 117,510 lowest level since 1961. This is down YoY 19.9%. If take into account FEMA both years (Katrina), decline would have been 9.7%.

2. MH Lenders seeing significant strengthening in loan application activity.

3. Weakness in key states of California, Arizona and Florida.

4. Projects 120,000 units for 2007, but acknowledges total lack of visibility.

5. Top 3 lenders have indicated to BB&T they are seeing a relatively sharp up tick in loan applications. They consider top 3 to be 21st Mortgage (Berkshire), Origen and Triad (privately held). Backlogs of manufactures still low, but watch this closely. One lender mentioned to watch the March backlogs for flow through of application pickup. One lender claimed FICO is increasing in the mid 600 FICO, but that verification is stringent.

6. Loan approval ratios have been steadily improving.

February 7, 2007 13G filings

| 12/31/06 | 12/31/05 | Change | |

| Gary Shiffman (c.) | 22,500 | 15,833 | 6,667 |

| Paul Halpern (b.) | 22,500 | 15,833 | 6,667 |

| Woodward Holding (a.) | 1,750,000 | 2,750,000 | (1,000,000) |

| Redfield, Blonsky | 1,915,680 | -0- | 1,915,680 |

a. Woodward on 12/31/05 13g mentioned that 1,000,000 option shares were included in the total, and that they expired 1/06. Does not appear to be a sale of 1M shares, but I could be wrong.

b. Halpern includes the Woodward shares in his filing. I have removed these. I could be wrong in doing that.

c. Shiffman includes 5M shares owned by Sun OFI LLC. I could be wrong in removing them.

December 8, 2006 Bingham Notes – These notes are not put on our website

November 29, 2006 Notes

1. Items to Discuss

a. A few analysts mentioned that they wish you relaxed your credit standards. They felt that would bring up volume of revenues. I was wondering yours and Ron’s thoughts on that. I would prefer an answer not being, “we will take that under advisement,” or “we explore all avenues.” Personally, I enjoy tight standards, at the sacrifice of current volume. But you guys are the mavens, and certainly not me.

b. costs, benefits and disadvantages of eliminating REIT status.

c. considerations of buyback and perhaps insider purchases.

d. Form POS AM filed 5/9/2005, is that the most comprehensive original filing. It seems like it is just a completed S11.

e. How is Bingham, Woodward, Sun and Shiffman involved in operations.

f. Please discuss the proposed offering of $200M of common stock. 1,540,000 shares at prevailing rates. What is status. I am confused on the $200M.

g. You purchased loans from Sun during 2004, and 2006. How are the performances of these loans?

h. Review beneficial owners below: On Def14A Halpern owned 1,750,000. Is this actually owned by Woodward? Shiffman, according to Def14A owned 5M shares more. On Edgar shows different, is that because of Sun?

i. I am under the assumption there are anti takeover provisions set up this year. Where is filing and what are they.

j. Ask Andy for flow through of all cash and shares issued to start company.

k. Ron/Andy – Who are your favorite companies in the industry. Do you own any MH companies in your own portfolios as long term core investments. Would you identify them?

l. What % HUD? What is difference between HUD and modular. What are current trends? What are expected trends?

m. Any Military work?

n. How is CountryPlace affecting you. How do you compare in requirements? Have you considered merger with them. I am familiar with a board member and major investor.

o. How does repo market affect you.

p. What have credit trends been. Can these be monitored via your abs reports from the ambac 2006 securitization.

q. How can I follow the securitizations. Is there a primary master trust?

r. What are you seeing in dealer inventories?

s. What is typical square footage of units? Is that listed in any of the ABS reports on your site.

t. CHB said on 10/25/06, “Typical California customer previously paid cash. They would sell their expensive site home, and purchase with cash a modular, which was much less expensive.” What does ORGN have to say on that ?

u. Why don’t you work with Cavco? In their 10/20/06 they did mention you as one of the industry channel sources. They also mentioned 21st Century (owned by same company as Pampered Chef) and US Bank.

v. Have you considered putting your conference calls on Thomson Street Events?

w. What is your dream scenario for the industry?

x. Do you read Grant’s Interest Rate Observer?

y. What is typical down payment? What is required down payment?

z. How large is TX business?

aa. With housing slowdown, do you think you could get mortgage brokers to start working with you? Have you seen any change in that regard?

bb. Can you explain the hedging. When would one expect to make money hedging? What were the dynamics to cause the losses in 3Q06 versus gains 3Q05?

2. According to ORGN, “GAAP accounting specifies that loan loss reserves should reflect “inherent” losses. Inherent losses are those that are identifiable based on an observed characteristic of a loan, such as delinquency status, a deterioration in the loan collateral, a known condition of the borrower that would indicate an inability to pay, etc. Also, GAAP accounting requires a matching of revenues and expenses by period. Accordingly, recognition must be given to the timing of the anticipated loan loss, since revenue is recognized over the term of the loan.”

3. According to ORGN on 9/25/06 there are 275 employees. All executive officers listed in the IPO prospectus are still with the company.

4. According to ORGN, “For 2006 year to-date, Santiago Financial, Manufactured Home Mortgage, San Jose Advantage Homes, U.S. Financial Networks and Western Finance are our five largest customers, representing about 20% of our loan fundings.”

5. According to ORGN, “In addition to our auditors, Grant Thornton, our major service providers and vendors would include the law firm of Hunton & Williams (loan securitization transactions), the law firm of Jaffe, Raitt, Heuer & Weiss (general corporate legal), the major credit bureaus (customer credit reports), JP Morgan Chase (banking services to include loan custodial functions and trustee services relating to our securitization transactions) and American Modern Insurance Company (force-placed casualty insurance on the loans we service).”

6. Beneficial Ownership I constructed. Could have errors.

| Shares | % | |

| Klein | 533,238 | 1.4% |

| Shiffman | 17,500 | |

| Halpern | 17,500 | |

| Rogel | 42,500 | |

| Wechsler | 17,500 | |

| Williams | 17,500 | |

| Scherer | 98,152 | |

| Geater | 91,774 | |

| Landschulz | 98,365 | |

| Sergi | 30,085 | |

| Sun OFI | 5,000,000 | 19.6% |

| Woodward | 1,750,000 | 6.9% |

| TAV | 2,213,525 | 8.7 |

| Wesley Cap Mgt | 1,917,161 | 7.5 |

7. PHHM mentioned on 10/18/06 CC that “more and more of secondary buyers, whether that is Fannie, Freddie, Hud or just investor buyers are putting loans back on originators, which is causing them to tighten standard significantly….”

a. They mentioned that average down payment is “about 17%. We require as low as 5%.

b. Mentioned they are working through “title 1” reform. I need to learn more about that , and see if ORGN is affected at all.

c. Mentioned that Berkshire lenders were heavy in volume.

d. Average fico 680 – 690.

e. HUD is strong.

f. Wrote off an investment in BankSource Mortgage.

8. Run Altman Z

9. Quick thought….. If ORGN sees improvement, maybe customers see improvement. Hometown America is not listed, as they are privately owned. “They are a major MH community owner, and our most significant source of third party fee income.”

a. CAVALIER HOMES IN (CAV) “Cavalier is a good source of chattel loans for us, but actually competes with us in the land/home category.”

b. CHAMPION ENTERPRISES (CHB) “Champion is a major manufacturer of MH and we do a good bit of business with their retail arm, but they seem to be moving out of the retail side.”

c. FLEETWOOD ENTERPRISES (FLE) “Fleetwood, another major manufacturer, is a good source of loans for us, from their independent retail operations.”

d. PALM HARBOR HOMES (PHHM) “Palm Harbor, also a manufacturer, is a competitor through their CountryPlace finance subsidiary.”

e. SUN COMMUNITIES INC (SUI) “Communities (owner of 20% of our stock) is a community owner/operator/developer and has been a minor source of loan business and also a source of third party income from loan processing and servicing.”

10. Champion CC on 10/25/06

a. HUD code business in an accelerated decline over last few quarters. Primarily in California and Florida. Doesn’t envision pick up at least till 2Q07. Yet does see an improvement, just might not show till mid year.

b. 4th quarter seasonally slow.

c. “ we can clearly see credit standards in the site-built market tightening up, and that is definitely going to have a positive impact on the manufactured housing customer.” They are surprised they haven’t seen this change yet.

d. Typical California customer previously paid cash. They would sell their expensive site home, and purchase with cash a modular, which was much less expensive.

11. Champion Analyst meeting on November 7 and 8, 2006

a. MH weakness driven by California, Arizona and Florida.

b. Expects rebound “sometime in 2007.”

c. Expects 130,000 units shipped in 2007. I have seen recent guesses for 2006 at 122,500. Those estimates have already been reduced twice this year from 140,000, to 125,000.

d. Discussed a modular sub-division project in Charlotte. They claim that attendees saw products were comparable to site built. Claims 1/3 the price ($150 Sq. Foot site built).

e. Implied a HUD code CAGR rate of 20% for next 5 years.

12. Cavco 10/20/06 CC.

a. January through March is typically strongest quarter. October through December is typically weakest, with a shut down in last two weeks of December.

b. Competition from site houses is because they do not require a down payment. Tuff to compete with.

c. Good reception in Texas. I am not certain, but seems like new industry for them. I remember being at a MH conference a few weeks ago. They said watch Texas because of the massive amount of available land, traditionally a good area and multi-generations are used to MH living.

13. I read a report from BB&T Manufactured Housing Monthly. They cite http://www.manufacturedhousing.org/default.asp as a source of information. From their report, I quickly constructed the following:

Originations question for 3Q06

| 21st Mortgage | Origen | |

| Applications | 17,588 | |

| Approval Ratio | 46.4% | |

| Average Chattel Loan Size | $38,141 | |

| Chattel Loan Volume | 2,605 | |

| Chattel % | 71.6% | |

| Total Loans/Applications | 18.3% | |

| Total loans / Approvals | 39.5% | |

| FICO < 625 | ~34.0% | |

| FICO 625 – 699 | ~34.0% | |

| FICO > 700 | ~32.0% |

They claim that Vanderbilt lends to 450 Clayton owned dealer network, whereas 21st Century lends to independent dealers. They again claim the data is manipulated from “trade magazine advertisements.”

I made the following table from some of their data:

| 21st Mortgage | Origen | |

| Origination Growth 4Q05 | 60.5% | |

| Origination Growth 1Q06 | 60.5% | 10% |

| Origination Growth 3Q06 | 24.1% (chattel up 11.2%, land/home up 74.9% | 0.7% |

March 29, 2006 CC Notes 3/14/06

1. “Year-over-year shipments for single section homes were up over 200% reflecting that demand, while shipments for multi-section homes, which are the core of our business, were down over 5%.”

2. “We believe that manufactured housing will do well in areas where there is a clear affordability advantage for manufactured housing versus site built, and this can also be seen in December’s shipment data where shipments were up in 19 states and down in 24 states.”

3. “We are hopeful as we move through 2006 that the continued abatement of the repo overhang, as well as higher interest rates that we have been seeing for the past several months, will translate into higher demand for manufactured housing as the affordability factor of manufactured housing comes into play.”

4. “In this type of market, we believe adhering to credit guidelines is paramount. Unlike many of our competitors, we are not relaxing our credit, waiving conditions, or otherwise returning to some of the common practices of several years ago that contributed to the implosion of our industry.”

5. “The credit performance of our loan portfolio has thus far exceeded our expectations. At the end of February, our 30-day plus delinquency number was at a company record low and our delinquent dollars were lower than our year ago numbers, while we did increase our loan portfolio by over $200 million.”

6. “We expect to resume the payment of a dividend in the first quarter of ’06.”

7. “The amount outstanding on our Citigroup loan warehouse facility at December 31st ’05 was 65.4 million which represents approximately 33% utilization of the capacity of that facility.”

8. “And roughly, while 65% of our loans have 700 plus FICO, that means 35% are less than 700, including some at the, you know, 620 mark as well. What we really see is that many of our competitors are still offering and pushing 30-year loans, as opposed to ours where we’re trying to drive down the term because that builds value dramatically.”

9. “And, depending on the various market, we see different competitors. We see banks. We see credit unions. You know, we do see, you know, obviously, you know, Berkshire’s independent ARM is out there that we compete against, you know, and they’re formidable. And, you know, that would be the basic biggest captive out there.”

10. “The second thing is that as we — as time passes and the deals continue to perform, that capital gets unlocked and gets returned to us. So, you know, we’re anxiously awaiting that occurrence too, but typically there’s a four-year lockout.”

Just Some Notes:

1. Institutional Holdings as of 3/24/06

Institutional Holdings

ORIGEN FINANCIAL INC

ORIGEN FINANCIAL INC COM

Company Summary

Number of Owners: 49 Initiated Positions: 8

Institutional Ownership: 50.550 % Total Shares: 12,869,243

| Institutional Holders Institution | Shares | Filing Date | Source | Change | % Change | % Portfolio |

| Third Avenue Management LLC | 2,213,525 | 12/31/2005 | 13F Form | 370,825 | 16.750 % | 0.090 % |

| Wesley Capital Management LLC | 1,917,161 | 12/31/2005 | 13F Form | (446) | (0.020)% | 1.160 % |

| Scopia Management, Inc. | 1,732,394 | 12/31/2005 | 13F Form | 420,453 | 24.270 % | 2.540 % |

| UBS Securities LLC | 1,014,485 | 12/31/2005 | 13F Subfiler | 109,339 | 10.780 % | 0.020 % |

| Boston Partners Asset Management LP | 623,255 | 12/31/2005 | 13F Form | (13,145) | (2.110)% | 0.040 % |

| Robotti & Company, Inc. | 591,059 | 12/31/2005 | 13F Form | 234,312 | 39.640 % | 1.610 % |

| Perry Capital | 560,699 | 12/31/2005 | 13F Form | 0 | 0.000 % | 0.050 % |

| Force Capital | 521,932 | 12/31/2005 | 13F Form | 0 | 0.000 % | 0.770 % |

| Echo Street Capital Management LLC | 488,583 | 12/31/2005 | 13F Form | 488,583 | 100.000 % | 3.690 % |

| Sterling Capital Management Co. | 412,785 | 12/31/2005 | 13F Form | (87,590) | (21.220)% | 0.130 % |

| JAM Partners LP | 392,500 | 12/31/2005 | 13F Form | 392,500 | 100.000 % | 1.750 % |

| Cramer Rosenthal McGlynn LLC | 325,110 | 12/31/2005 | 13F Form | (34,900) | (10.730)% | 0.020 % |

| Barclays Global Investors NA (CA) | 235,729 | 12/31/2005 | 13F Form | 10,327 | 4.380 % | 0.000 % |

| TIAA-CREF Asset Management LLC | 169,976 | 12/31/2005 | 13F Combined | 17,400 | 10.240 % | 0.000 % |

| Western Investment LLC | 168,600 | 12/31/2005 | 13F Form | 0 | 0.000 % | 0.350 % |

| FrontPoint Partners LLC | 165,200 | 12/31/2005 | 13F Form | 165,200 | 100.000 % | 0.040 % |

| SSgA Funds Management | 159,383 | 12/31/2005 | 13F Form | 11,410 | 7.160 % | 0.000 % |

| Deutsche Bank Investment Management, Inc. | 158,799 | 12/31/2005 | 13F Subfiler | (1,102) | (0.690)% | 0.000 % |

| Columbia Management Advisors, Inc. | 109,641 | 12/31/2005 | 13F Subfiler | (462) | (0.420)% | 0.000 % |

| Windcrest Discovery Investments LLC | 88,200 | 12/31/2005 | 13F Form | 88,200 | 100.000 % | 0.380 % |

2. Watch the yield curve. Wondering if yield curve flattening is positive or negative for ORGN. On one hand, the spread reduces, hence profit reduces. On the other hand, perhaps the flatness could cause tighter environment, which in turn could help the MH market. I’m just thinking out loud on the above, and could be very wrong.

March 23, 2006 Notes to 10-K and discussion with CFO from ORGN.

1. I asked ORGN about their thoughts on loan provisions for Katrina losses. Any guess on reserves? The response was that it looks like their projections on recoveries was conservative. ORGN claims they were not trying to be conservative, they were trying to be accurate. They are being cordially lenient with hurricane victims. They will do this for a period of time. They want the victims to have an opportunity to get back on their feet.

2. SPE’s exist, according to ORGN all debt is listed on balance sheet.

3. What is industry average on FICO and also on defaults? What is greatest risk? ORGN explained that FICO scores do not cover income, geographics and demographics. Whereas ORGN’s proprietary scoring system does include income, geographics and demographics. ORGN claims that their system has been back tested and that it is a better predictor of credit worthiness. ORGN claims they are typically , but not always a more conservative tool.

4. What is typical customer? ORGN claims that typical customer has annual income of $28K to $34K, yet California customer (Sacramento and north) has higher income of $70K. Typical loan is $42K. According to CFO, the typical loan to value is 80%. The typical loan to purchase cost is 60% to 70%. I asked about aggressiveness in the industry. ORGN replied, “SACU is most aggressive, U.S. Bank next. Gift letters are fairly common, rate buy-downs and cash payments to dealers are the most common of the aggressive tactics in MH.” According to CFO, about 5% of ORGN’s business is refinance. ORGN claims that typical customer has FICO score of 720 –722, 35 – 45 years old.

5. How will you grow stockholders’ equity over the years? ORGN claimed they will not be able to with REIT status. I sense that ORGN is eventually looking to eliminate REIT status. I have discussed this with uppers at TAV. They hinted to me that perhaps REIT status will be abandoned. Keep in mind that investment can grow, as REIT earnings are paid out.

6. I asked the CFO what calculation of REIT income was. His response was, “The formula is contained in several hundred pages of tax code. The largest differences are (1) Book loan losses versus tax loan losses–only actual losses incurred are deductible for tax (2) Goodwill amortization–it is amortizable for tax, not book and (3) excess inclusion–which is phantom income produced from REMIC structures that are used for ABS transactions.”

7. Number of employees in 2005 was 255 and 266 in 2004.

8. Who are the subs of Berkshire? The Clayton subs on page 6 looked confusing. Do they include 21st Mortgage, Vanderbilt Finance, US Bank, San Antonio FCU and Triad? Subs are only 21st and Vanderbilt. The others listed above are competitors.

Origen claims that 21st is their direct competitor. Origen has hinted at competitors relaxing standards and claimed that they are certainly including and probably focusing on 21st in that mold. According to ORGN, Berkshire has issued bonds for 21st Mortgage and Vanderbilt Finance.

How is Berkshire spread compared to ORGN spread? Does their cost and access of capital increase their spread, and at same time keep risks same as or lower than ORGN? ORGN responded that they are probably with in 50 basis points (bps) on short-term and 100 bps on long-term paper. Claims that Berkshire does not go to ABS market.

Please comment on this, “But, Berkshire’s cost of financing is lower than probably any other market participant so they can afford, if they want, to underwrite loans with a different standard. Berkshire is getting I think an obscene spread on these loans (600-650 bp or more), and this is only going to increase as interest rates increase. Berkshire floated long term debt at something like 25bp above treasuries a while back and they use that to support the Clayton financing.”

ORGN claimed the above is not accurate. I need to clarify the discussion of “600 – 650 bp or more.”

9. What is greatest risk to stockholders’ equity and eps. ORGN claimed , “if ABS market dried up.” I need to review Asset Back Alert http://www.abalert.com . I also should review Manufactured Housing Institute. There seems to be a lot of available information via a google search. Here is one that ORGN mentioned http://www.manufacturedhousing.org/default.asp Interesting thing to follow is to make sure ORGN receives update of LBP certification (Lender Best Practices). The site has what appears to be an interesting section on statistics.

10. Please comment on this, “It looks like they IPO’ed in May 2004. What part, if any, did they play in the manufactured housing disaster of the early 2000’s? I believe that various lenders (who were in many cases also the manufacturers) were allowing LTV’s up to 130% with no money down, and default rates were crazy, something like 25-50%. This is the wasteland from which Berkshire bought Clayton.

What is the default rate for ORGN’s loans? I can’t find their credit/default rate assumptions in the 10-K.

It looks like they got a ~416 basis point spread on their financing in 2004, yet still managed to lose money. Why?”

ORGN mentioned that they were formerly Dynex Capital (pre-IPO). New ORGN is not at all the company that Dynex was.

ORGN claims default rate is 12% over the life of the loan, and the defaults typically peak in years 3 to 5. ORGN claimed that the industry average is higher. I would like to externally verify that at some point.

11. ORGN claims that losses referred to above were merely legacy issues.

12. What is purpose of recent 424b3. Any info in that , not in 10K? Just an update, no dilution planned, all info the same as K, per ORGN.

13. How would rising unemployment and a recession affect you? At first ORGN claimed those factors would have a negative impact. I mentioned that rising unemployment and recessions are a natural recurring event, and was surprised to hear that response. ORGN claimed that they often look at bad scenarios, and thinks they could weather a storm. They claim to not issue variable rate loans. ORGN claims to not issue interest only loans or balloon loans.

14. Self insurance. CFO claims that the self insurance is a proven and prudent method. Claims to have been doing this for years. Their Third Party Administrator (TPA) is Weyco. CFO claims that ultimately the cost to ORGN could not be “catastrophic.” According to CFO, The individual stop- loss is $50,000 a year for each individual.” They claim to typically have 2 or 3 each year that hit the stop loss.

15. If insider sells, are they required to notify SEC via filing in all cases? ORGN responded as “yes.” CFO claimed that around 100K shares will each vest in 5/06 and 5/07.

16. CFO explained restricted cash in Balance Sheet as, “cash held by someone else.” CFO mentioned there is always a listed corresponding liability.

17. Consensus estimate for F2006 is $0.31 and F2007 is $0.47. I think that only two analysts follow ORGN.

18. These are notes from a friend of mine. “First here are some random notes going through their 2005-A prospectus. There is a 2005-B too.

65% new homes, 35% used

weighted average LTV 83%

weighted average original loan-to-invoice ratio 130% *

average principal balance: $46,966.02

weighted average contract rate: 9.387%

weighted average remaining term to stated maturity: 222 months

weighted average credit score: 718

30% CA, 10% TX, no other significant concentration”

19. I asked CFO the following question. I have never heard of a “loan to invoice” ratio. Googling around, I only see this mentioned by Origen and Sun Communities. Maybe this is a metric you all came up with. The prospectus offers this definition: “The loan-to-invoice ratio is determined using the total loan amount divided by the manufacturer’s invoice price for the underlying manufactured home.” I don’t understand how you can have an LTV of 83% and a “LTI” of 130%. This was identified in 2005 A securitization. How can the “value” and “invoice” be different by 50%? ORGN responded with, “It is a metric that we came up with. The rating agencies (Moody’s and S&P ) agree that it is more meaningful in our industry than LTV (loan-to-invoice). It is a measure of how much we advance for a loan versus the manufacturer’s invoice, which is the wholesale price. The availability of reliable appraisal data is a problem for MH in all states except California and Florida.” “This relates to the LTI comments above. The “V” in LTV is generally the retail sales price of the unit unless a reliable appraisal is available. Since dealers are notorious for charging widely varying prices for the same identical unit, “V” is not a great indicator of buyer’s equity in the deal. The LTI measures the relationship between the wholesale cost and the amount financed by the lender. The amount financed by the lender typically includes the wholesale cost of the unit, the dealer’s profit, transportation costs and siting costs.”

20. Are there any covenants in place that are predicated on your stock price? ORGN said, “no.”

21. Does the price below book value and near tangible book value have any financial effect? ORGN responded,” The only impact is to make it more difficult to justify no impairment of the $32 million of Goodwill we carry on our books. We are able to do so primarily because our loan servicing rights are carried on our books at a fraction of their market value and there is no recorded value for our loan origination platform.”

22. Do you expect any asset write downs in the near or mid future? ORGN responded with the following, “That’s a loaded question. If we expected any write-downs, accounting principles would require that we should have already made provision.”

23. Buffett talked about the industry in his letters since the Clayton acquisition. He says that securitizers front-load their income and that income is dependent upon a receptive secondary market. ORGN responded, “ I haven’t read his comments yet, but the only way to front-load income is to use “gain on sale” accounting. Depending on how a securitization is structured, it can be “gain on sale” or “financing.”” Would you consider ORGN as the type of company he referred to? ORGN responded, “Origen only uses “financing” accounting, which means we carry the securitized loans on our balance sheet as well as the debt issued against the loans. Thus, it is “earn as you go”, with no front-loading.”

24. Do you have any projections for F2006 and further in both eps and dividend? ORGN responded, “Certainly we have internal projections, however, our Board of Directors has determined that we will issue no guidance.”

25. I asked the CFO to kindly comment on the following paragraphs? “There are infinite shades of gray in how the securitizations are set up. “Gain on sale” accounting is usually a road to hell. Management can book whatever income they want based on their assumptions, and then obligate themselves to a dividend based on those earnings. In a cyclical business, this is a recipe for disaster. They have a good year, because of either actual goodness or optimistic assumptions, and report high numbers and a high dividend. They pay all of their capital out as a huge dividend, then they hit a bump and run into a liquidity crisis, and can’t fund new business. Once the stock trades below book, they can’t issue new equity. ORGN responded, “Refer to my response to item 23 above. While far from “infinite”, those who use “gain on sale” have to make a number of subjective judgments regarding the variables that determine the accounting results. Such variables include an appropriate discount rate, average loan life, the timing and amount of loan defaults and loan recoveries, and an appropriate value of the loan servicing rights over the life of the loan portfolio.”

26. Different companies have different ways of handling this. NFI “resecuritizes” their securities a second time to realize cash from them. ORGN responded, “This undoubtedly refers to “NIM’s” or net interest margin securitizations, whereby the excess spread in a transaction is securitized. We accomplish something similar with our OC or “over-collateralization facility with CitiGroup.” I further asked CFO to respond to this comment: “The industry also play bizarre games with their taxes to delay the realization of income. But this is a general problem among MREIT’s.” CFO responded with, “I’m not familiar with the games referred to, but there are some bizarre aspects to REIT taxes relating to securitization transactions. There is an animal created by the Treasury Department called “excess inclusion” that creates phantom income for certain investors in REIT’s (non-profits and foreign companies).”

27. Who are your largest customers? ORGN responded, “On a monthly basis, 10 retail customers (dealers) comprise about 17% of our sales, with the largest retailer comprising about 6%. Also on a monthly basis, ten brokers account for about 32% of our business with the largest contributing about 6.5%. So each month 20 customers provide about 50% of our business. However, there is significant movement from month to month within the ranks of our top 10 retailers and brokers, such that on an annual basis, about 35-40% of our customers provide about half our business.”

I asked the following, “Can you list by name as many of your largest customers. Do you work with Palm Harbor, Sun Communities, Nobility, Cavalier, Clayton ( i imagine not), Cavco, Champion, Coachmen, Monaco, Thor and Winnebago?” Understandably ORGN could not be specific in answering that question. They did mention that they do business with Sun (rarely a top 10 customer) , Fleetwood, Cavalier, and Champion. They do no business with Palm Harbor and Clayton.

28. I asked ORGN CFO to comment on the following: “Do you know offhand what ORGN’s interest is, if any, in their own securities? Does ORGN retain any tranches or do they sell the whole thing? I saw that 91% of their securities are backed by borrowings. What is the other 9%? I need to start going through their securitization reports. Do you retain any tranches of the securities, or are they all sold to ABS investors? I’m guessing not; it looks like the whole loans are kept on the balance sheet and are partially offset by the securities.” The response was, “I’ve spoken about OC (over-collateralization previously). This is, in effect, the equity we leave in each deal. Over the past two years this has ranged from 10% to 14%, with the % declining for each subsequent deal as our loan quality improves and as our deal performance gives the rating agencies more confidence in our deals. It is rare that we retain a tranche in our deals, since our OC is relatively high. However, if we think a particular tranche is priced too wide to the market, we may retain such tranche, as we did for a $4 million B piece, I believe in our Origen 2004-B deal.”

29. I asked CFO to comment on the following: “Looking at the prospectuses for the 2005 deals, it looks like there is an implied CPR (constant prepayment rate) of about 12-13%. Understanding that this is just a guesstimate, is that typical for the industry, and would you expect that on future deals? From an income modeling perspective the prepayment and default rates are the primary variables. In contrast, sub-prime lenders are seeing CPR’s in the 30-40% range in the first 2 years and 50-60% in the 3rd and subsequent years.” His response was, “I would not expect much change in future deals. Our CDR in the first two years are running around 27% and year three forward about 40%.”

30. In the JPM report you sent, this was mentioned: “Conseco’s MH performance has once again improved in June. 30+ delinquencies, excluding repossessed inventory, were flat at 4.5% range for the past three months. REO improved to record low level of 1.85%, or $262 million. Recoveries strengthened 108bp to 23.6%, the highest level since November 2002. Although defaults remain more than twice as much as the pre-blowout levels, they have been stable at 6% to 7% range since the beginning of the year.”

That’s where I got my 6-7%. If the default rate is >= 12%, that is pretty high. Think about it, almost one in ten. Maybe Conseco is 6-7% while the industry is 12-13%? If so where does ORGN fall?

CFO responded, “The Conseco numbers are for well-seasoned portfolios that have already absorbed the bulk of their losses. The experience of these pools in earlier years were pretty abysmal. Our performance is far ahead of Conseco and the industry as whole.”

31. Please comment on this, “If use the “bucket with a hole” model, that is, loans go in the top of the bucket, and they fall out of two holes, for prepayments and defaults. As long as they’re in the bucket, they provide gross earnings, which is the spread. Plug in numbers for these (origination, prepays, defaults, and spread), and you can model the income. In the sub-prime world, prepays are 30-60% (that’s 60% per year!), while defaults are around 4-6%, so prepays are a much larger issue. It sounds like in MH, they are both around 12-13%, so equally important.” ORGN responded, “Over time, yes. But in first couple of years, prepays significantly higher than defaults, since defaults are low until years 3-5.”

32. is a typical loan ARM or fixed rate? Are there any “teaser rates” or other such structures? CFO responded, “We do not make ARM loans or use teaser rates. Our customers cannot deal with payment shock.”

33. What is the prepayment rate? CFO responded, “About 7% annually.”

34. I discussed the recent stock price drop. It went from 6.80 to 5.98 in a rather short period. In the last 2 weeks it went from 6.30 to 6.00. I mentioned we understand no one can project stock price, and that we had no objections to lower price as accumulator’s. ORGN assured me that nothing was inherently wrong with the business or the model.

35. 95% of ORGN loans are Chattel paper. Chattel paper is loan on home and not on land.

36. I asked ORGN, What type of investments are in “Investments held to Maturity”? ORGN responded that these are debt securities that we purchased for investment purposes. They are all from the MERIT bonds issued by Dynex Financial, Inc. and we service all of the underlying loans. We know the loans better than anyone, and we felt the securities were undervalued by the market, so we have made selective purchases.

Disclaimer

If you are a client of ours, and if you have questions regarding Origen Financial, Inc., please call our office. If you are not a client of Redfield, Blonsky & Co. LLC Investment Management Division and are reading these notes, we urge you to do your own research. We will not be responsible for any person making an investment decision based on these notes. these notes are a “by-product” of our research. We are not responsible for the accuracy of these notes. We are not responsible for errors that may occur in these notes. Please do not rely on us to monitor or update this or any other report we may issue. In theory, we could come across some type of data or idea, which causes us to eliminate our long or short position of Origen Financial, Inc. from our portfolios. We will not notify readers revisions to these notes. We are not responsible to keep readers of these notes updated for changes or material errors or for any reason whatsoever. We manage portfolios for clients, and those clients are our greatest concern as it relates to investing. Certain clients of Redfield, Blonsky & Co LLC may not have Origen Financial, Inc. in their portfolios. There could be various reasons for this. Again, if you would like to discuss Origen Financial, Inc., please contact Ronald R. Redfield, CPA, PFS (partner in charge of investment management division).

Information herein is believed to be reliable, but its accuracy and completeness cannot be guaranteed. Opinions, estimates, and projections constitute our judgment and are subject to change without notice. This publication is provided to you for information purposes only and is not intended as an offer or solicitation. Redfield, Blonsky & Co. LLC and Ronald R Redfield, CPA, PFS, may hold a position or act as an advisor on any investments mentioned in a report or discussion.