Berkshire Hathaway, Inc.

Please see disclaimer at bottom of this document

April 5, 2006 MidAmerican Energy Holding (MEHC) More Notes

1. When reading about the debt, one has to understand that Berkshire does not guarantee that debt. The following is a quote from the annual report.

” At MidAmerican, we have substantial debt, but it is that company’s obligation only. Though it

will appear on our consolidated balance sheet, Berkshire does not guarantee it.

Even so, this debt is unquestionably secure because it is serviced by MidAmerican’s diversified

stream of highly-stable utility earnings. If there were to be some bolt from the blue that hurt one

of MidAmerican’s utility properties, earnings from the others would still be more than ample to

cover all debt requirements. Moreover, MidAmerican retains all of its earnings, an equitybuilding

practice that is rare in the utility field.

From a risk standpoint, it is far safer to have earnings from ten diverse and uncorrelated utility

operations that cover interest charges by, say, a 2:1 ratio than it is to have far greater coverage

provided by a single utility. A catastrophic event can render a single utility insolvent – witness

what Katrina did to the local electric utility in New Orleans – no matter how conservative its debt

policy. A geographical disaster – say, an earthquake in a Western state – can’t have the same

effect on MidAmerican. And even a worrier like Charlie can’t think of an event that would

systemically decrease utility earnings in any major way. Because of MidAmerican’s everwidening

diversity of regulated earnings, it will always utilize major amounts of debt.”

2. The annual report also discussed the debt in this fashion, “Specifically, MidAmerican’s debt is currently not guaranteed by Berkshire. However, Berkshire has made a commitment until February 28, 2011 that would allow MidAmerican to request up to $3.5 billion of capital to pay its debt obligations or to provide funding to its regulated subsidiaries.”

April 4, 2006 MidAmerican Energy Holding (MEHC) Notes from 10-K and misc. notes

This is how Berkshire describes MEHC: “MidAmerican owns a combined electric and natural gas utility company in the United States, two interstate natural gas pipeline companies in the United States, two electricity distribution companies in the United Kingdom, a diversified portfolio of domestic and international electric power projects and the second largest residential real estate brokerage firm in the United States.”

1. http://www.utilityforecaster.com is a subscription based newsletter covering the Utility Industry. I like to use it in a manner similar to Value Line. It is a source I go to for our utility investing. It is merely one of many sources. The best source of information is typically the SEC filings. The following is text from the April issue.

“Berkshire Hathaway will complete the purchase of PacifiCorp from Scottish Power in barely nine months. The speed is bound to whet Warren Buffett’s appetite for more deals.

One he might be eyeing is Xcel Energy, which serves 3.3 million electric and 1.8 million natural gas customers in 10 states. It also owns 15.8 gigawatts of low-cost generating capacity, two-thirds of which is stable-priced coal, nuclear and hydro. Recent successful rate cases prove management has repaired once-frayed regulatory relations as it reduces debt and operating risk. Trading at just 1.38 times book value, Xcel is a buy up to 19 for a takeover offer in the low to mid-20s.

The other big acquirer in the power patch is Britain’s National Grid, which has built a wires and pipes empire serving 3.1 million US customers. Grid faces a horrific regulatory environment in Labour ruled Britain, with allowed returns for its wires and pipes of just 6.25 percent. In contrast, its New York investments earn a 10.6 percent return on equity.”

2. Some metrics:

| Tangible Consolidated Book Value | ($770,929) |

| Total Consolidated Debt | $11.6 B |

| Sokol (CEO and COB) Total Salary 2005 | $14.7M |

| Abel (COO) Total Salary 2005 | $14.2M |

| MEHC Parent Debt | $4.4B |

3. Reading the financials, I certainly get concerned. Debt loads seem high, and this is before Pacificorp. Current ratio is less than 1. Keep in mind that a negative current ratio in Utility industry is not terribly uncommon. I am not sure if debt load is from a build-out of plant.

4. Miscellaneous Notes: Berkshire Hathaway owns 88% of MEHC (not publicly traded).

a. Closed its $5.1B acquisition of PacifCorp. Berkshire paid for this purchase in cash. bought from Scottish Power.

b. MEHC was looking for $3.25b in funding. They decided to reduce the amount to $1.7B. The note was a 30 year note, priced at 130bp over treasuries (5 pts wider than originally discussed).

c. I think even at $1.7B, this was the largest 30 year bond deal, ever.

d. Why did they bring down the amount? Perhaps because so few are familiar with MEHC, not followed, not researched. Berkshire known to be shrewd in financing. Buyers and street might realize Berkshires shrewdness and not want to be on other side of transaction.

e. MEHC has $16.4B of debt, of which 4.5b is senior and 1.4 is subordinated.

From NGI’s Daily Gas Price Index:

Coming off 2005 utility results in which net earnings tripled to more than half-a-billion-dollars, Berkshire Hathaway’s growth-hungry MidAmerican Energy Holdings Co. is looking at a two-fold jump in its electric utility customer base to more than 2.4 million, revenues of more than $3 billion and a total portfolio of utility energy assets exceeding $14 billion. These are the numbers Berkshire’s billionaire founder and CEO Warren Buffett spelled out in a letter to shareholders posted on the parent conglomerate’s website earlier this month.

Even without PacifiCorp in last year’s results, Buffett said the U.S. utility operations, along with Kern River interstate natural gas pipeline operations, pulled in nearly $600 million of income before corporate interest and taxes. Kern River contributed $309 million out of the $1.16 billion before interest/taxes.

With the repeal last year of the Public Utility Holding Company Act (PUHCA), Buffett noted that Berkshire earlier this year converted its 80% ownership of MidAmerican from preferred to common shares of stock. The utility operations continue to be what he called a “four-party ownership” among Berkshire, Walter Scott and the utility holding company’s CEO and president, respectively, Dave Sokol and Greg Abel. The foursome has to be in agreement before MidAmerican will pursue an acquisition or business strategy, Buffett said.

“Five years of working with Dave, Greg and Walter have underscored my original belief — Berkshire couldn’t have better partners,” Buffett wrote in his shareholder letter.

Buffett told his shareholders he doesn’t expect “outsized profits” from the regulated utility business, but it offers “fair returns” on large investments, and he made it clear the company is looking to acquire more utilities beyond last year’s PacifiCorp purchase, which closed last Tuesday.

MidAmerican’s varied assets include United Kingdom-based utilities, Yorkshire Electricity and Northern Electric, which showed $308 million in earnings before interest and taxes last year, compared to $326 million in 2004; its Iowa-based utility operations, which earned $288 million before interest/taxes in 2005, compared with $268 million the previous year; Kern River Pipeline, which brought in profits before interest and taxes of $309 million last year, compared to $288 million in 2004; and even the nation’s second largest real estate brokerage firm, HomeServices of America, which had earnings before interest and taxes of $148 million last year, compared with $130 million for the previous year.

f. ebitda expected of 3.3B (35% from PacifiCorp). this covers pro-forma interest expense by 2.5X.

g. capex expected to be 1B + for next 5 years.

h. Berkshire AAA rated, does not guarantee MEHC debt, yet Berkshire did sink in $3.5B and a 5 year equity commitment. through 2/8/11.

i. Buffett did say in recent annual report that he plans on buying more Utilities.

j. Here is what Standard and Poors had to say…

Separately, Standard & Poor’s Ratings Services announced last Wednesday that it raised PacifiCorp’s rating to “A-1” from “A-2” to reflect the completion of MidAmerican’s purchase of the Portland, OR-based utility from ScottishPower. The higher rating reflects S&P’s conclusion that the “utility’s short-term rating benefits from the explicit and implicit support that MidAmerican receives from its parent company, Berkshire Hathaway.”

S&P credit analyst Anne Selting said there is specific support in the form of a $3.5 billion equity commitment agreement between Berkshire and MidAmerican Energy Holdings Co. “It could be called upon to support the liquidity requirements of MidAmerican’s regulated subsidiaries, including PacifiCorp,” Selting said.

“In addition, S&P believes that due to Berkshire’s increased ownership interest in MidAmerican and its strategic focus on utility investments, it has incentives to treat PacifiCorp and MidAmerican’s other regulated investments, as core to consolidated Berkshire Hathaway operations,” she said.

As a further post-sale step Wednesday, S&P said it withdrew the credit ratings of PacifiCorp Holdings Inc. at the company’s request. The unit is a wholly owned subsidiary of ScottishPower and has no debt outstanding, S&P said.

PacifiCorp Holdings had been the guarantor of obligations entered into by ScottishPower merchant energy company, PPM Energy Inc., which the UK-based company still owns in the United States. PPM is one of the nation’s largest developers of merchant wind energy and natural gas storage projects.

k. The daily telegraph explained the sale as follows

SCOTTISH Power has become the latest FTSE 100 company to plug a hole in its final salary pension scheme by ploughing pounds 200m into its fund.

The Glasgow-based utility disclosed the plan as it completed the $9.4bn ( pounds 5.1bn) sale of its troubled former US subsidiary PacifiCorp to Warren Buffett’s MidAmerican Energy Holdings.

The sale of PacifiCorp has generated pounds 2.5bn of spare cash, most of which should be handed back to the company’s shareholders by early June.

However, Scottish Power revealed that it had decided to divert some of the cash into its final salary pension scheme, which is showing a deficit of around pounds 170m. The scheme is due to be closed to new members from April 6.

Philip Bowman, Scottish Power’s chief executive who is due to give more details on his strategy for the company in late May at the full year results, said he was delighted that the deal had been completed ahead of schedule.

The cash handback will include a B-share option which could minimise the tax bill for smaller investors. He said: “The sale will allow the group to concentrate on developing continuing businesses. It is appropriate to make that return after having taken into account the review of financing, the ability to invest in opportunities within the group to deliver attractive returns and the need to make additional payments to our group pension schemes.’

Scottish Power shares rose 3 to 587½p. Analysts have suggested that the sale clears the way for an auction of Scottish Power, with Scottish & Southern Energy and Germany’s E.on leading the pack of possible bidders.

According to analysts at US investment bank Merrill Lynch, the door is open for “a merger of equals’ between the two Scottish companies because E.on is distracted by its ?29bn ( pounds 20bn) hostile bid for Spain’s Endesa.

In a note, they said: “Scottish & Southern and Scottish Power have a significant opportunity to forge a merger of equals that would place the combined group solidly within Europe’s top 10.’

A combination of the two companies would have 24pc of the UK energy market, still some way behind market leader Centrica with 37pc, although local monopolies in some regions of the UK could trouble the regulator.

“Other suitors may appear for one or both companies. However, European power is changing rapidly and neither company can ignore the implications,’ Merrill said.

l. Barrons last week mentioned that head of MEHC might one day be on the docket to replace Warren at Berkshire

Who is that Berkshire manager? Our best guess is that it’s David Sokol, 49, the chief executive of MidAmerican Energy, Berkshire’s utility arm and the largest single earnings contributor to Berkshire after its insurance operations. While relatively young, Sokol has significant experience as a CEO, has demonstrated deal-making skills and appears to possess the ambition and ego needed to fill Buffett’s enormous shoes. And since Berkshire is likely to do additional utility acquisitions beyond the pending $5 billion purchase of the Oregon electric company PacifiCorp, Sokol’s experience in the field would be a boon.

It probably doesn’t hurt that Sokol was raised in Buffett’s hometown, Omaha, and went to the University of Nebraska. He works in Omaha, giving him easy access to the boss. Sokol was the wunderkind who ran a public company, Ogden Projects, when he was in his 20s. In 1991 he took the helm at California Energy, merged it with MidAmerican, an Iowa utility, and then sold MidAmerican to Berkshire in 2000. He elicits consistent praise from Buffett, who called Sokol and MidAmerican’s president, Greg Abel, “terrific managers” in the annual letter.

We first tipped Sokol for the chief’s post in our cover story “Buffett’s Legacy,” on April 26, 2004. Like our current assessment, it was based on discussions with investors who closely follow Berkshire, and on our coverage of the company for the past seven years. We have no inside knowledge; Buffett and Sokol have declined to comment. Meanwhile, Buffett deflected attention by noting that he feels “terrific.” Given his good health, he could be at the helm at least another five years. He relishes the job, and most Berkshire holders want to see him running the show for as long as he can.

While many feel that Buffett, whose 32% stake in Berkshire is worth $45 billion, is irreplaceable, Berkshire

March 31, 2006 Wesco Notes from 10-K

1. Net income was 294,579. Yet, if you eliminated the realized capital gains, the gain would be as follows:

| Net Income before taxes | $435,804 |

| Less: Realized Cap Gains | (333,241) |

| Net adjusted Income | 102,563 |

| Less: Taxes | ( 34,871) |

| Net Income adjusted After Taxes | 67,692 |

| Weighted Average Shares Outstanding | 7121 |

| Net Adjusted EPS | $9.51 |

The $9.51 of adjusted eps shows nice growth from 2004 eps of 6.66. Sure seems like a good year.

Dividends and interest income increased by 19,948. I wonder how much of that is reoccurring. How much will it increase with rise in short term rates? If not reoccurring, then might want to reduce from Net Income After Taxes

2. I love the conservatism in the letter and in the financials (except for a condo in this market? ) I kid on the condo , small potatoes, so what’s the difference. I like the allocation to safety, until opportunity appears.

“All that now remains outside Wes-FIC but within Wesco as a consequence of Wesco’s former involvement with Mutual Savings, Wesco’s long-held savings and loan subsidiary, is a small real estate subsidiary, MS Property Company, that holds tag ends of appreciated real estate assets consisting mainly of the nine-story commercial building in downtown Pasadena, where Wesco is headquartered. Adjacent to that building is a parcel of land on which we have begun to build a multi-story luxury condominium building. We are also seeking city approval of our plans to build another multi-story luxury condominium building on a vacant parcel of land in the next block.”

3. Insurance premiums going down. that seems cool where Charlie I guess is trimming risk, and letting business pass by, just like the old days.

4. ” Business and human quality in place at Wesco continues to be not nearly as good, all factors considered, as that in place at Berkshire Hathaway.”

“All that said, we make no attempt to appraise relative attractiveness for investment of Wesco versus Berkshire Hathaway stock at present stock-market quotations.”

” Wesco’s consolidated balance sheet reflects total assets of $2.7 billion as of yearend 2005. Of that amount, more than $1 billion has been invested in cash equivalents and fixed-maturity investments since early in 2003. Unless those funds can be attractively reinvested in acquisitions, equity securities or other long-term instruments of the type that have been responsible for the long-term growth of Wesco’s shareholders’ equity, future returns on shareholders’ equity will probably be less than those of the past. Due to the current size of Wesco and its parent, Berkshire Hathaway, Wesco’s opportunities for growing shareholders’ equity are unlikely to be as attractive as in the past.”

A List of some subsidiaries of Berkshire:

| Company name | Website | Product or Service |

|---|---|---|

| Fechheimer | http://www.fechheimer.com/ | Uniforms |

| Forest River | http://www.forestriverinc.com/ | RV’s and Cargo trailers |

| H.H. Brown Shoe | http://www.hhbrown.com/ | Shoes and boots |

| Johns Manville | http://www.jm.com/ | Insulation and roofing |

| Justin brands | http://www.berkshirehathaway.com/subs/justin.html | Boots |

| MiTech | No website | ???? |

| Pampered Chef | http://www.pamperedchef.com/ | |

| Precision Steel Warehouse | http://www.precisionsteel.com/ | Precision Steel products |

| Home Services of America | http://www.homeservices.com/ | 2nd largest real estate brokerage in USA. |

| Scott Fetzer | http://www.berkshirehathaway.com/subs/scotfetz.html | This is a huge conglomerate, see companies below |

| Adalet | http://www.adalet.com/index.asp | Industrial Wireless Products |

| Altaquip | http://www.altaquip.com/ | Repairs of power equip products |

| Campbell Hausfeld | http://www.campbellhausfeld.net/ | Equipment products |

| Quikut | http://www.quikut.com/ | Ginsu knives |

| France | http://www.franceformer.com/ | Power and light products |

| Halex | http://www.halexco.com/ | Electrical, roofing and die cast |

| Meriam | http://www.meriam.com/ | Industrial instruments |

| Northland | http://www.northlandmotor.com/ | Industrial motors |

| Scottcare | http://www.scottcare.com/ | Medical devices |

March 13, 2006 Gathering more data, asking more questions

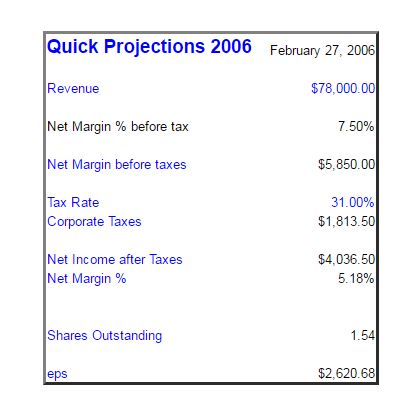

1. I am trying to determine look-through earnings for Berkshire. I suspect the analysis done on March 3 (below), was too conservative in projection of earnings. I will try to rehash that over time. Here is a real quick run through.

| Net Income Before Taxes and Minority Interests | $12,791 |

| Less: Insurance Investment Gains and Losses | ($5,728) |

| Less: Finance Investment Gains and Losses | ($ 468) |

| Add: Derivative Losses | $ 788 |

| Net adjusted Income before Taxes | $7,383 |

| Less: Income Taxes (using 40% state and local rate) | $2,953 |

| Net Adjusted Income after Taxes | $4,430 |

| Add: Look Through Earnings Estimate | $4,177 |

| Total normalized earnings | $8,607 |

| Shares Outstanding | 1.54 |

| Total Normalized Earnings per share | $5,589 |

The 10-K uses a different approach in calculating “Total Normalized Earnings.” This is prepared on “Consolidated Statement of Changes in Shareholders’ Equity and Comprehensive Income.” The calculation works similar to mine above, but basically takes Net Operating Earnings and subtracts “other comprehensive income.” Based on my infancy with this industry, and Berkshires common thread of clarity and proper presentation, I would gather that their presented figure is correct. See table below:

| Total Comprehensive Income as presented in 10-K | $5,453 |

| Look Through Earnings estimate | $4,177 |

| Total normalized earnings | $9,630 |

| Shares Outstanding | 1.54 |

| Total Normalized Earnings per share | 6,253 |

2. Shares outstanding as of March 8, 2006 are 1,540,950. This was listed in Form DEF 14A

3. Interesting table of insider holdings. This is not a complete table, but notice how Charles Munger does not own that many shares. I am curious why Charles owns such few shares. Easy enough to research, but really not important.

| Name | Shares Beneficially Owned |

|---|---|

| Warren E. Buffett | 498,326 |

| David Gottesman | 18,234 |

| Charles T. Munger | 15,811 |

Notes on Form 10-K

1. ” All of Berkshire’s major insurance subsidiaries are rated AAA by Standard & Poor’s Corporation, the highest Financial Strength Rating assigned by Standard & Poor’s, and nearly all are rated A++ (superior) by A.M. Best with respect to their financial condition and operating performance.”

2. General Re owns approximately 91% of Cologne Re as of December 31, 2005.

3. Geico is the nations 4th largest auto insurer.

4. ” In May 2005, General Re terminated the consulting services of its former Chief Executive Officer, Ronald Ferguson, after Mr. Ferguson invoked the Fifth Amendment in response to questions from the SEC and DOJ relating to their investigations. In June 2005, John Houldsworth, the former Chief Executive Officer of Cologne Reinsurance Company (Dublin) Limited (“CRD”), a subsidiary of General Re, pleaded guilty to a federal criminal charge of conspiring with others to misstate certain AIG financial statements and entered into a partial settlement agreement with the SEC with respect to such matters. Mr. Houldsworth, who had been on administrative leave, was terminated following this announcement. In June 2005, Richard Napier, a former Senior Vice President of General Re who had served as an account representative for the AIG account, also pleaded guilty to a federal criminal charge of conspiring with others to misstate certain AIG financial statements and entered into a partial settlement agreement with the SEC with respect to such matters. General Re terminated Mr. Napier following the announcement of these actions.”

5. “Berkshire’s preferred strategy is to hold equity investments for very long periods of time. Thus, Berkshire’s management is not troubled by short term equity price volatility with respect to its investments provided that the underlying business, economic and management characteristics of the investees remain favorable. Berkshire strives to maintain above average levels of shareholder capital to provide a margin of safety against short-term equity price volatility.”

Notes on Annual Statement of General Re from NAIC (www.naic.org)

Selected Data

| Description | 2005 | 2004 |

| Bonds | 2,861,902,243 | 4,233,936,864 |

| Preferred Stocks | 328,065,167 | 404,315,913 |

| Common Stocks | 6,679,410,515 | 5,135,408,282 |

| Cash | 2,948,526,889 | 7,864,623,796 |

| Total Assets (this is not a subtotal of above) | 14,632,646,158 | 19,614,060,601 |

| Total Liabilities | 6,738,561,441 | 12,455,074,155 |

| Surplus as regards policyholders | 7,894,084,717 | 7,158,986,446 |

| Net Income | 721,128,937 | 485,835,702 |

| Net Cash from Operations | (4,703,227,070) | (1,443,114,534) |

Selected Five-Year Historical Data

| 2005 | 2004 | 2003 | 2002 | 2001 | |

| Gross Premiums Written | 1,721,457,921 | 2,366,705,883 | 3,288,291,831 | 3,842,802,623 | 3,979,621,643 |

| Net Premiums Written | (4,482,375,051) | 2,262,406,745 | 3,129,032,326 | 3,631,594,785 | 3,684,357,603 |

| Net Income | 721,128,937 | 485,835,702 | 831,591,338 | 578,553,066 | (1,402,405,132) |

| % distribution of invested assets | |||||

| Bonds | 20.9 | 22.6 | 29.1 | 59.3 | 67.0 |

| Stocks | 51.1 | 29.6 | 21.9 | 18.7 | 21.6 |

| Cash and Short Term investments | 21.5 | 42.0 | 43.0 | 14.8 | 8.0 |

| Other | 6.5 | 5.7 | 6.0 | 7.1 | 3.4 |

| Operating Percentages | |||||

| Premiums Earned | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Losses Incurred | 96.3 | 69.6 | 66.2 | 69.1 | 145.3 |

| Net Underwriting gain (loss) | 0.5 | (8.6) | (2.3) | (4.5) | (83.2) |

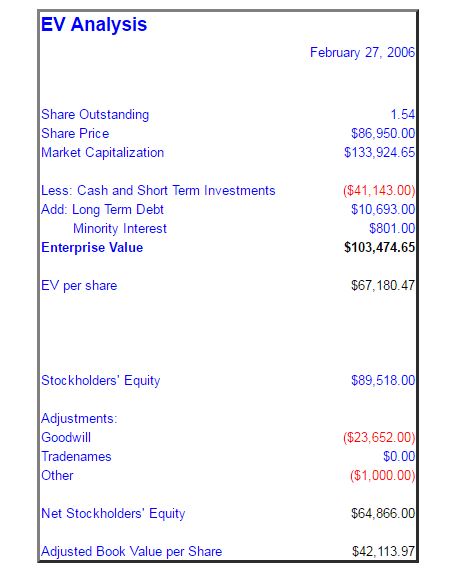

March 3, 2006 Some back of the envelope analysis.

The following is some back of the envelope valuation work for Berkshire. Berkshire seems to be impossible to do real valuation analysis. The business model is based on insurance, float and a collection of investments. The flow through of all these parts, because of accounting rules, do not necessarily flow through consistently into the financial statements. That is the primary reason that Warren Buffett suggests using “look-through earnings.” With that said, I am trying to ascertain a margin of safety in our investment. I made a variety of vague assumptions. There could be errors galore in my assumptions, the theories of assumptions, the applications of the assumptions and in the spreadsheets I used. Please do not use this in making your investment decisions. I have tried to be conservative in the assumptions used.

| FV of current equity and future earnings | 27-Feb-06 |

|---|---|

| Tangible Book Value | $64,866.00 |

| Net Profit | $4,036.50 |

| Growth Rate of Net Profit for 10N | 8.00% |

| Growth Rate of Net Profit after 10N through 15N | 8.00% |

| FV of Net Profit in 10N | $8,714.50 |

| FV of Net Profit in 15N | $12,804.46 |

| FV of tangible book value plus Net Profits for 10N | $198,515.84 |

| FV of tangible book value plus Net Profits for years 11 – 15N | $342,809.39 |

| Current Enterprise Value | $103,474.65 |

| FV of tangible book value plus Net Profits for 10N | ($198,515.84) |

| Years | 10 |

| ROI on tangible book value plus Net Profits for 10N | 6.73% |

| FV of tangible book value plus Net Profits for 10N | $198,515.84 |

| FV of tangible book value multiplier | 1.50 |

| FV of Tangible Book Value using BV multiplier in year 10 | $297,773.76 |

| Current Enterprise Value | $103,474.65 |

| FV of tangible book value plus Net Profits for years 11 – 15N | ($342,809.39) |

| Years | 15 |

| ROI on tangible book value plus Net Profits for 15N | 8.31% |

| FV of tangible book value plus Net Profits for 15N | $342,809.39 |

| FV of tangible book value multiplier | 1.5 |

| FV of Tangible Book Value using BV multiplier in year 15 | $514,214.09 |

| Potential Future EV using BV multiplier above | |

| Current Enterprise Value | $103,474.65 |

| FV of Tangible Book Value using BV multiplier in year 10 | ($297,773.76) |

| Years | 10 |

| ROI on FV of Tangible Book Value using BV multiplier in year 10 | 11.15% |

| Current Enterprise Value | $103,474.65 |

| FV of Tangible Book Value using BV multiplier in year 15 | ($514,214.09) |

| Years | 15 |

| ROI on FV of Tangible Book Value using BV multiplier in year 15 | 11.28% |

| Sanity Checks: | |

| P/E in future | |

| FV of Net Profit in 15N | $12,804 |

| P/E estimate | 15.00 |

| Market Cap on above | -$192,067 |

| Years | 15 |

| Current Enterprise Value | $103,475 |

| ROI in 15N using above | 4.20% |

| Potential Revenue Growth | |

| Current Revenues | $78,000 |

| Growth Rate of Revenues for 10N | 8.00% |

| Growth Rate of Revenues after 10N through 15N | 8.00% |

| FV of Revenues in 10N | ($168,396) |

| FV of Revenues in 15N | $247,429 |

| FV of Revenues in 15N | $247,429 |

| Revenue Multiplier based on Al Meyer Rule of Thumb net margins | 1.5 |

| Possible Market Cap year 15 | ($371,144) |

| Years | 15 |

| Current Enterprise Value | $103,475 |

| ROI in 15N using above | 9% |

March 3, 2006 I have been studying Berkshire for some time now. I have recently re-read the shareholder letters from 1977 – 2004. I have been rummaging through some annual reports, SEC filings, discussions with knowledgeable Berkshire students, etc. etc. Via that collection of data, I have been trying to take notes, and perhaps dive into some questions, which one day I hope to have greater clarity on. The following are some of those initial notes.

1. I found the SQUARZ interesting. It is my interpretation that BRK pays 3% on this note, yet collects 3.75% from warrant holders. I believe that give BRK a net collected of 0.75%? I’m wondering if price will be held down till warrant expiration 5/07.

2. Try to monitor FICO scores of Clayton customers for financing.

3. There have been more recent acquisitions of businesses that in my opinion could be more recession proof than the old Berkshire. I could be real wrong on that. Here are some examples. My gut is telling me that BRK is more recession prone than ever before. I need to analyze the size of the “recession prone” businesses and see if that could have a material adverse affect on the entire value of Berkshire if hard times hit. My thesis in recent years has been the eventual exhausted consumer and a potential housing bubble. I think I should read back annual reports to 1977, and see if I can gather an extra feel for the future vision, strategy and capital deployment. Perhaps these types of investments have been core since the start of Berkshire as a non-textile business.

| Company | Date Purchased | Business Type |

|---|---|---|

| Mitek | 2001 | Roofing components |

| Net Jets | 1998 | time sharing of planes |

| Jordan’s Furniture | 1999 | Retail |

| MidAmerican Energy | 2000 | Utility Company |

| CORT | 2000 | Rental Furniture |

| Justin | 2000 | Boots and Bricks (Acme) |

| Benjamin Moore Paints | 2000 | Paints |

| Johns Manville | 2000 | Insulation |

| XTRA | 2001 | Truck and Container Leasing |

| Fruit of the Loom | 2001 | underwear |

| Larson-Juhl | 2001 | Picture Frames |

| Garan | 2002 | Clothing Maker |

| CTB International | 2002 | a manufacturer of equipment for the livestock and agricultural industries |

| The Pampered Chef | 2002 | Kitchen products |

| McLane Company | 2003 | Wholesale Distributor of grocery items |

4. I need to review investment of Value Capital LP. In 2004 this was listed as $503M investment.

5. Buffett has continually praised Joe Brandon and Tad Montross from GenRe. I believe, but could be wrong, that Brandon is involved with SEC probes. I seem to recall there are allegations of Brandon and AIG using side letters in a reinsurance transaction. I am not aware of any closure in this matter in regards to Berkshire. I found no alleged improprieties on my search of Montross.

6. I need to do more investigation on cost of float. I have obtained industry books which might give me an historic prospective on the typical cost of float. What is industries historic cost of float, underwriting profit or loss percentage, etc.

7. I would like to extrapolate at some point in the future the table that Warren laid out in the 2003 shareholder letter, page 3.

Year Operating Earnings in $ Operating Earnings per share CAGR of earnings

I could further extrapolate such a table to include, CAGR for Book Value as well.

8. I admire the simplicity of 2004 discussion on page 10, where WEB discusses that if there were a $100B loss, that Berkshire’s share would probably be 3% to 5%. This statement makes it simple and understandable.

9. I read in a 1999 report by analyst Alice Schroeder that $10K invested in 1965, would be worth about $51M in January 1999. If no shares were sold, there were very little taxes ever paid, as the last dividend was in 1967.

10. Warren recently commented on Trader Joes. http://www.anderson.ucla.edu/course/asam/ . In that link you can see he mentioned the following fun facts:

a. Would love to own Traders Joe’s or In-N-Out Burger. Would prefer Trader Joe’s and will give a finder’s fee to whoever brings him the deal. Once wrote a letter to owner of In-n-Out and never got a response. Doesn’t write many letters; wants people to come to him with deals.

b. Loves chocolate covered cherries and gingerbread cookies from Trader Joe’s.”

11. When valuing Berkshire, I think it would be neat to see BRK discount the NAV of publicly traded companies because of their liquidity discounts. There is a company called Capital Southwest that taught me that method.

12. The following is a cut and paste of an email I sent to our clients in regards to Geico Insurance.

“Hi guys,

You are receiving this email because you are an investment client of our firm (and we appreciate your business!). Most of our investment clients, with portfolios over $25,000 have Berkshire Hathaway (BRK.B) in their portfolio. Berkshire owns 100% of Geico Insurance. It is my understanding that Berkshire shareholders receive an 8% discount on their auto insurance. Please keep that in mind if you are a current policyholder of Geico, or if you are looking for auto insurance.

I just applied online, also spoke to customer service. Here are my notes from the experience.

” I just applied online, which incidentally was very easy. I then called customer service, which incidentally they were a pleasure to speak with. I spoke to a woman from Buffalo NY. We compared my current policy with NJ Manufacturers, which is rated number 1 rated in most recent issue of Consumer Reports (3/06), with a 94 rating, as Geico was 12th with an 86 rating.

We made every selection identical to my current policy. I have 2 cars, live in NJ and fairly clean records. We were quoted with the shareholder discount of 8%.

End result is Geico is $2,504 per year ($1,252 every 6 months) and my NJM policy is $1,840 per year (including the dividend).

I mentioned this to the Geico representative, she mentioned that as a shareholder I probably already know the great financial strength of the company. She requested that I try again in 6 months. Again, a very pleasurable experience.

I just wanted to relay this, thought it might be beneficial.”

Have a great one,

ron”

Keep in mind that NJ Manufacturers (NJM) is a special type of insurance company. They only cater to member businesses, and drivers must qualify and remain qualified. It is much easier to be pushed out of NJM than it is to get in. In NJ they are known as high quality and very Buffett like in their business. a very fair, but strict organization.

With all that said, here are some of my client responses to my emails , telling them about an 8% discount Geico offers for Berkshire shareholders.

” Just called. I am currently a policy holder and I will save now save over 700.00 more per 6 month policy thanks again.”

” Thanks Ron…..You saved me $200. Your such a great financial advisor. Nice going on Dylan’s push down the mountain! (only kidding) If I don’t speak to you good luck on your race!”

” I was so pleased when I saw you bought the BRK.B stocks and in connection with that you looked into Geico Insurance. We bought Geico Auto and Homeowners insurance when we first moved to D.D. and have had the same great experience with them these past seven years.

The term “Partnership Organization” led Geico Customer Service to the right info and DC residents are eligible to receive the 8% discount. However, we are not because of our status of “Preferred” we have their “top-notch discounts” already and they cannot go any lower.”

” Personally, I would never lead NJ Mfg Insurance Co. if I were you. They are the absolute best. I had them throughout my NJ days…

Thanks.”

” I called Geico and will be saving $174 per year”

Disclaimer

If you are a client of ours, and if you have questions regarding Berkshire Hathaway, Inc., please call our office. If you are not a client of Redfield, Blonsky & Co. LLC Investment Management Division and are reading these notes, we urge you to do your own research. We will not be responsible for any person making an investment decision based on these notes. these notes are a “by-product” of our research. We are not responsible for the accuracy of these notes. We are not responsible for errors that may occur in these notes. Please do not rely on us to monitor or update this or any other report we may issue. In theory, we could come across some type of data or idea, which causes us to eliminate our long or short position of Berkshire Hathaway, Inc. from our portfolios. We will not notify readers revisions to these notes. We are not responsible to keep readers of these notes updated for changes or material errors or for any reason whatsoever. We manage portfolios for clients, and those clients are our greatest concern as it relates to investing. Certain clients of Redfield, Blonsky & Co LLC may not have Berkshire Hathaway, Inc. in their portfolios. There could be various reasons for this. Again, if you would like to discuss Berkshire Hathaway, Inc., please contact Ronald R. Redfield, CPA, PFS (partner in charge of investment management division).

Information herein is believed to be reliable, but its accuracy and completeness cannot be guaranteed. Opinions, estimates, and projections constitute our judgment and are subject to change without notice. This publication is provided to you for information purposes only and is not intended as an offer or solicitation. Redfield, Blonsky & Co. LLC and Ronald R Redfield, CPA, PFS, may hold a position or act as an advisor on any investments mentioned in a report or discussion.